In a startling development that has sent ripples through the cryptocurrency ecosystem, Galaxy Digital has orchestrated a significant drain of over 17,000 BTC—worth more than $1.7 billion—within just 24 hours. This mass transfer, captured by Arkham Intelligence, points to a calculated maneuver rather than a simple liquidity adjustment. The scale and timing of these transactions raise serious questions about the motives behind such a strategic redistribution of assets that appear to be aimed at destabilizing market confidence. Unlike typical institutional operations which tend to prioritize stability, this series of large transactions indicates a potential intention to induce panic selling or to profit from a temporary dip in prices.

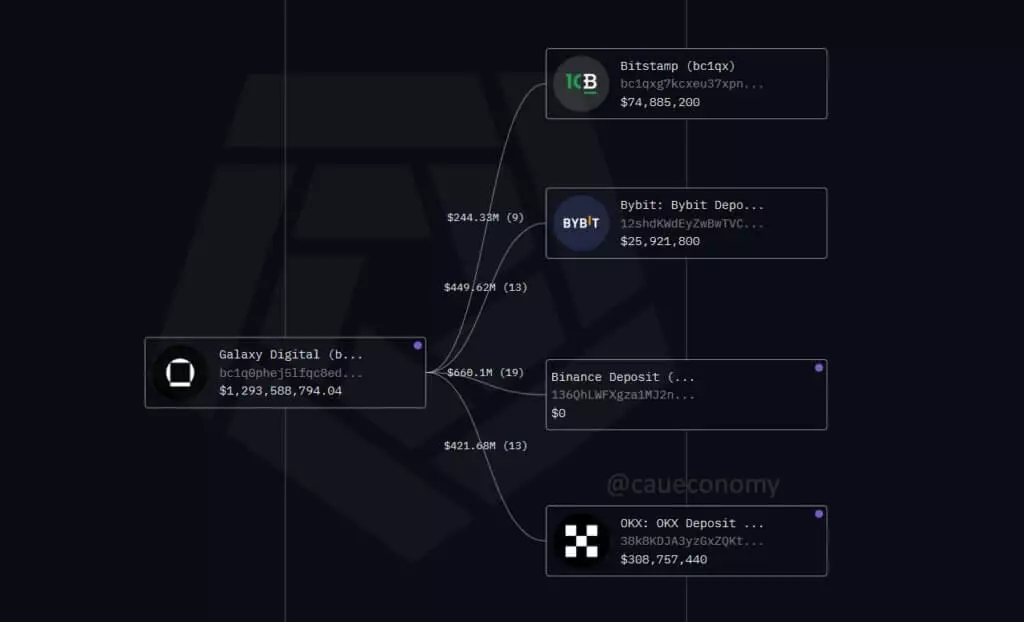

This abrupt outflow follows a remarkable period between mid-July, during which Galaxy Digital’s holdings surged from a modest $850 million to over $6 billion. A key event was the consolidation of 80,000 BTC—long dormant since 2011—onto active wallets, signaling an aggressive stance toward asset reallocation. The highest-profile move was a colossal 10,000 BTC deposit, often associated with custodial arrangements, but subsequent transfers reveal a pattern of funds being deliberately dispersed to various exchange platforms, including Binance, OKX, and Bitstamp.

Market Impact and the Silent Strategy of Distribution

The timing of these transfers coincides with a notable decline in Bitcoin’s price, which has fallen roughly 2.5% to hover around $115,600. Although the crypto market remains robust with daily volumes exceeding $94 billion, the mounting sell pressure appears to be more than mere coincidence. Analysts, such as Cauê Oliveira of BlockTrends, have identified a consistent outflow of approximately 40,000 BTC from major wallet clusters over the past week—an unambiguous signal that significant players are initiating a strategic unwind.

What is particularly revealing is the pattern of these Bitcoin movements. The tokens are leaving the custody of Galaxy Digital’s primary wallets but are not being held idle; instead, they are moving incrementally into exchange hot wallets. This staggered distribution aligns with a typical pattern of market liquidation rather than a cautious transfer to secure cold storage. The slow drip of Bitcoin onto exchanges suggests the firm’s intent to offload these assets gradually, possibly to avoid a sudden price crash but with undeniable downward pressure in mind.

Implications for Market Stability and Regulatory Concerns

Such substantial on-chain activity by a major institutional player fuels fears that the market could be entering a phase of heightened vulnerability. By strategically releasing large volumes of Bitcoin into circulation, Galaxy Digital seems to be either capitalizing on current volatility or intentionally exacerbating it to facilitate profit-taking. While the firm has yet to confirm the purpose behind these transfers, the pattern unmistakably signals an active position in market dynamics that could threaten broader systemic stability.

From a political and economic standpoint, these developments cast a shadow over the integrity of institutional influence in the crypto space. Supplying exchanges with massive volumes of Bitcoin during a period of market fragility raises concerns about market manipulation—whether voluntary or systemic—triggered by profit motives or strategic positioning. Meanwhile, retail investors, already wary of the volatile nature of Bitcoin, are likely to interpret these signals as a warning sign that larger forces are willing to risk market turmoil to serve their interests.

This situation underscores the need for tighter regulation and transparency, especially concerning large institutional actors whose actions can sway market sentiment and price trajectories. Given the current scenario, one cannot dismiss the possibility that a calculated strategic unwind by Galaxy Digital might be the first wave in a broader trend of financial maneuvering—an unsettling reminder of the volatile power dynamics that continue to shape the cryptocurrency landscape.

Leave a Reply