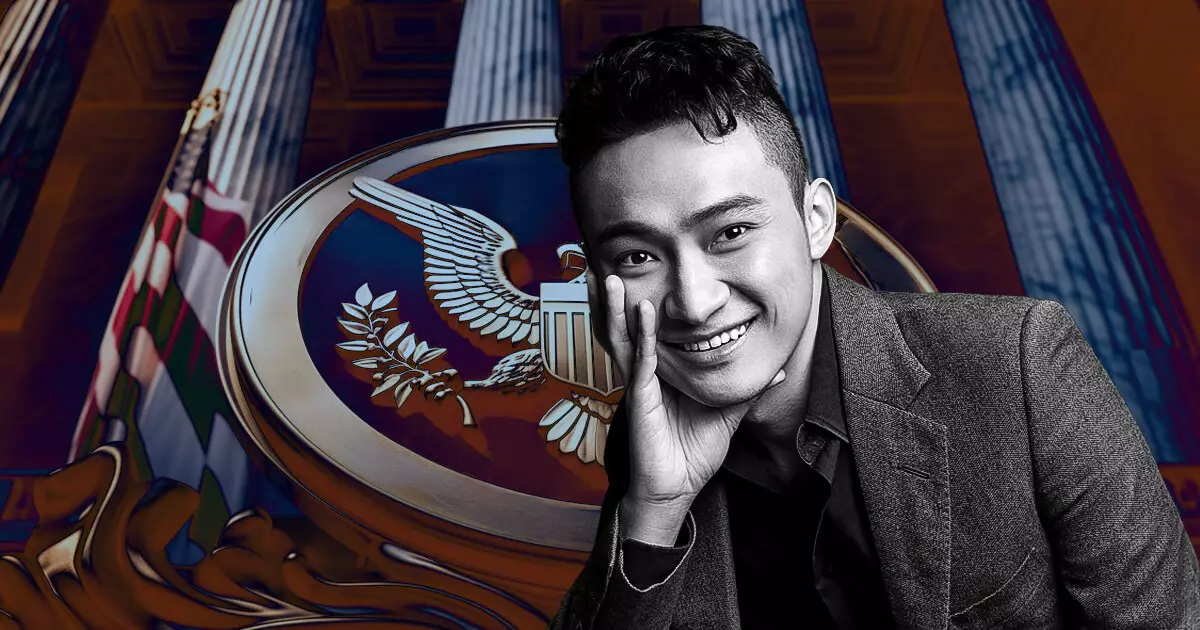

The recent amended complaint filed by the US Securities and Exchange Commission (SEC) in its case against Justin Sun and other defendants raises important questions about jurisdiction and legal actions related to the unregistered offers and sales of cryptocurrencies. The SEC’s argument revolves around Sun’s alleged extensive visits to the US, claiming that these trips should grant the jurisdiction necessary to pursue regulatory and legal action against him and the companies involved.

Allegations and Jurisdiction Claims

The regulator asserts that Justin Sun “traveled extensively” to the US between 2017 and 2019, spending over 380 days in the country and making business trips to major cities such as New York City, Boston, and San Francisco on behalf of the Tron Foundation and the BitTorrent Foundation. These visits, according to the SEC, establish a basis for jurisdiction over Sun and the companies to pursue legal action in the US.

One of the key allegations in the SEC’s amended complaint is that Sun and the companies engaged in a wash trading scheme on the now-defunct crypto exchange, Bittrex. While the initial complaint mentioned similar activities, it did not specify the exchange where the wash trading occurred. By naming Bittrex as the platform where these activities took place, the SEC further strengthens its claims to personal jurisdiction over the defendants.

Furthermore, the amended complaint mentions that Justin Sun personally communicated with Bittrex in 2018, providing documents to have the exchange list the TRX cryptocurrency. These communications and document signings link Sun to the companies involved, reinforcing the SEC’s argument for jurisdiction in pursuing legal action against them.

In response to the SEC’s allegations, defense lawyers for Sun argued that he is a foreign national and not domiciled in the US, challenging the regulator’s claims of personal jurisdiction. Despite Sun’s dismissal request in March citing a lack of personal jurisdiction, the amended complaint addresses these concerns and strengthens the SEC’s case against him and the companies involved.

The SEC initially sued Justin Sun and the other defendants in March 2023, primarily focusing on jurisdiction claims related to investor activities in the Southern District of New York and the involvement of celebrity promoters contacting individuals in the US. In April 2023, the SEC separately sued Bittrex, eventually settling the case in August 2023. Subsequently, Bittrex ceased its operations globally by the end of 2023.

The SEC’s amended complaint against Justin Sun and other defendants underscores the importance of jurisdictional claims in pursuing legal and regulatory actions related to unregistered cryptocurrency offerings. The ongoing legal proceedings and settlements highlight the complexities and challenges in enforcing securities laws in the rapidly evolving crypto market.

Leave a Reply