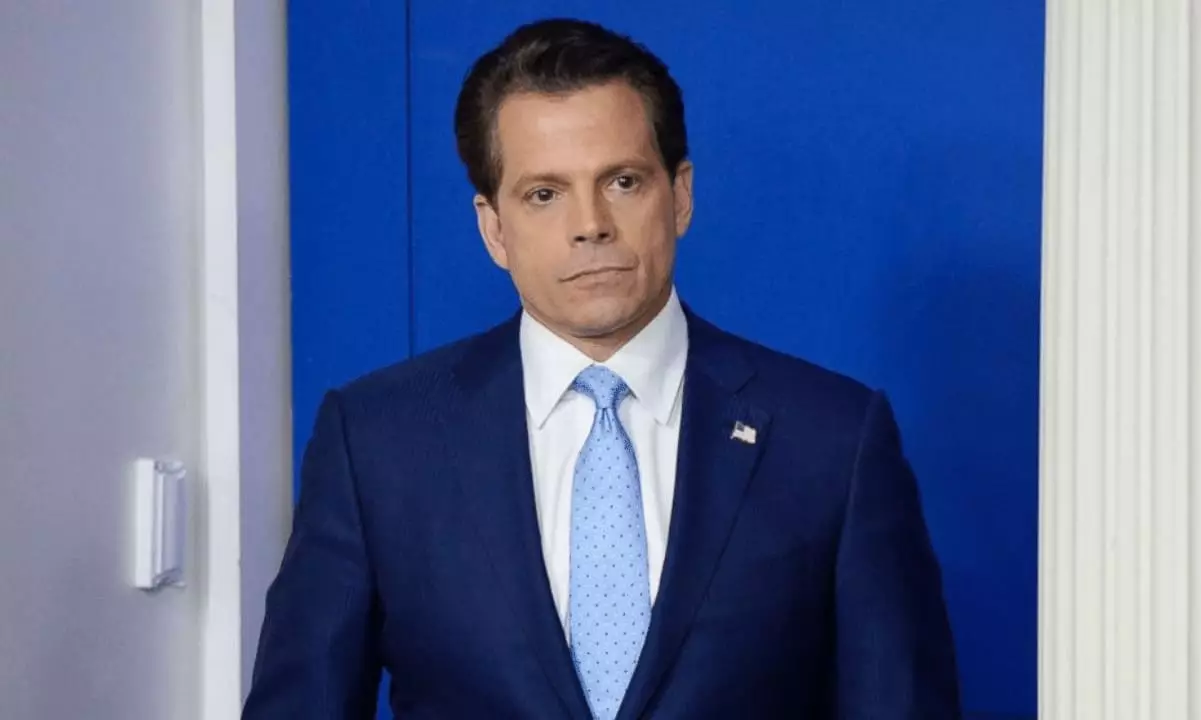

Anthony Scaramucci, the founder and CEO of alternative asset management firm SkyBridge Capital, has expressed his belief that Bitcoin (BTC) will soar to new heights, surpassing its previous all-time high, before the end of 2024. In an interview with CNBC, Scaramucci highlighted the recent approval by the United States Securities and Exchange Commission (SEC) for spot Bitcoin exchange-traded funds (ETFs) as a pivotal moment for the cryptocurrency market.

The SEC’s greenlighting of 11 spot Bitcoin ETFs for listing and trading on prominent exchanges like Nasdaq, the New York Stock Exchange (NYSE), and the Chicago Board Options Exchange (CBOE) marks a long-awaited breakthrough. The approval grants retail investors access to BTC, offering an alternative investment option and accelerating the adoption of cryptocurrencies.

Scaramucci, echoing sentiments of the crypto community, describes the SEC’s decision as a watershed moment for Bitcoin and digital assets as a whole. He believes that the approval signifies a significant breakthrough and predicts that Bitcoin will not only surpass its previous all-time high before the year-end but also continue its upward trajectory well into the next year.

After reaching its all-time high during the previous bull market in November 2021, the cryptocurrency market witnessed a bearish period in 2022, with Bitcoin and various other projects experiencing a significant price contraction. However, BTC’s price rebounded in 2023, surging by 150% due to excitement surrounding the spot Bitcoin ETF approval and upcoming events such as the fourth Bitcoin halving, historically correlated with bull markets.

Scaramucci reflects on SkyBridge’s tumultuous journey, describing 2022 as a difficult year for the company. However, he notes that 2023 turned out to be highly fruitful after the firm strategically acquired Bitcoin, Ether (ETH), and Solana (SOL). Scaramucci believes the SEC’s endorsement of Bitcoin, by allowing investors to include the digital asset in their brokerage accounts, is a unique form of support.

When asked about his own participation in Bitcoin ETFs, Scaramucci affirms his intent to be a ceremonial buyer, indicating confidence and support for the newly approved investment vehicles. It is a testament to his positive outlook on Bitcoin’s future growth potential and the broader implications for the cryptocurrency market.

Anthony Scaramucci’s predictions for Bitcoin’s future performance convey an optimistic outlook. With the SEC’s approval of spot Bitcoin ETFs and the increasing interest in cryptocurrencies, BTC is poised to surpass its previous all-time high, contributing to the ongoing growth and adoption of digital assets.

Leave a Reply