Recent discussions surrounding the registration process for token-based companies have brought to light the inadequacy of the current Form S-1 requirements. Billionaire investor Mark Cuban and SEC Commissioner Mark Uyeda have shed light on the challenges faced by crypto issuers, urging the SEC to consider modifications to accommodate the unique characteristics of these companies.

Form S-1, the registration statement mandated by the SEC for public offerings of new securities, currently poses obstacles for crypto issuers due to its standardized requirements. These requirements, which include details on business operations, risk factors, and product offerings, may not accurately capture the intricacies of token-based companies.

Commissioner Uyeda has proposed allowing variances in Form S-1 filings for crypto digital assets, similar to the flexibility provided for funds and insurance products. This approach aims to enhance the relevance of material information disclosed by crypto issuers, ultimately benefiting both investors and the companies themselves.

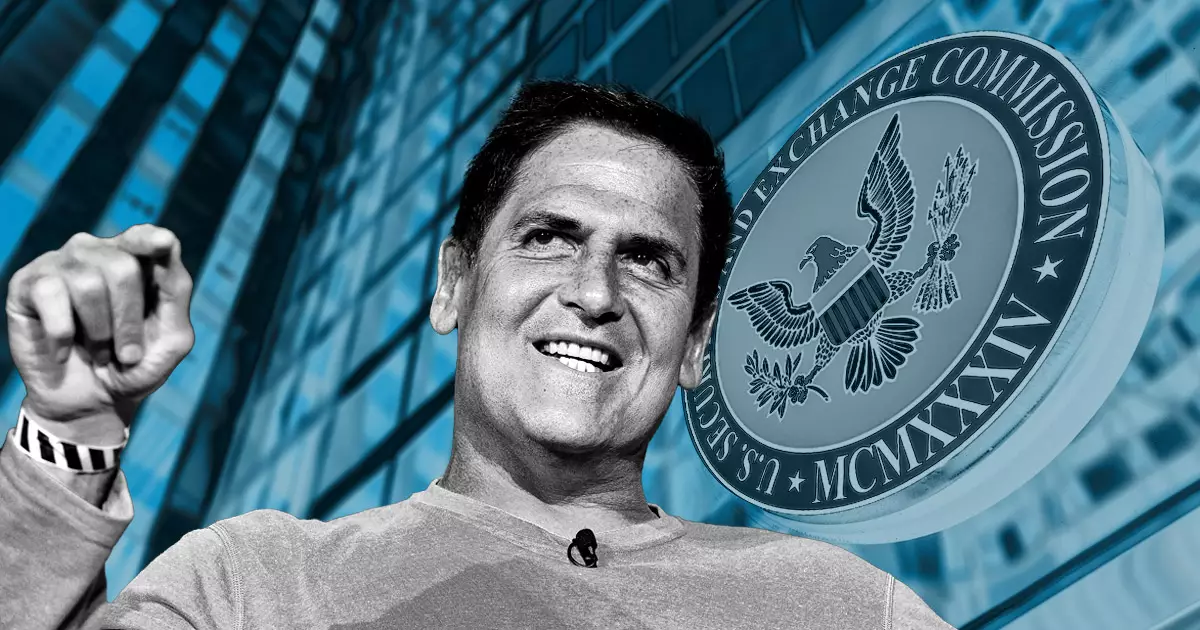

Mark Cuban voiced his support for Uyeda’s proposal, emphasizing that the current registration process is ill-suited for token-based companies. Cuban highlighted the impracticality of fitting these companies into the traditional Form S-1 requirements, pointing out the absence of any registered and operational token-based companies as evidence of the mismatch.

In addition to Cuban’s endorsement, the US Blockchain Association has commended Uyeda for his insightful engagement with the industry. The recognition of the need for regulatory adjustments reflects a growing acknowledgment of the unique challenges faced by crypto issuers in complying with existing regulations.

As the crypto industry continues to evolve and expand, it is essential for regulators like the SEC to adapt to the changing landscape. By revisiting and modifying Form S-1 to better accommodate token-based companies, the SEC can foster innovation while ensuring investor protection and capital formation.

The current discussions surrounding Form S-1 modifications for token-based companies highlight the need for regulatory flexibility in response to emerging technologies. By heeding the calls for change from industry leaders like Mark Cuban and Commissioner Uyeda, the SEC can position itself as a proactive regulator capable of addressing the evolving needs of the digital asset space.

Leave a Reply