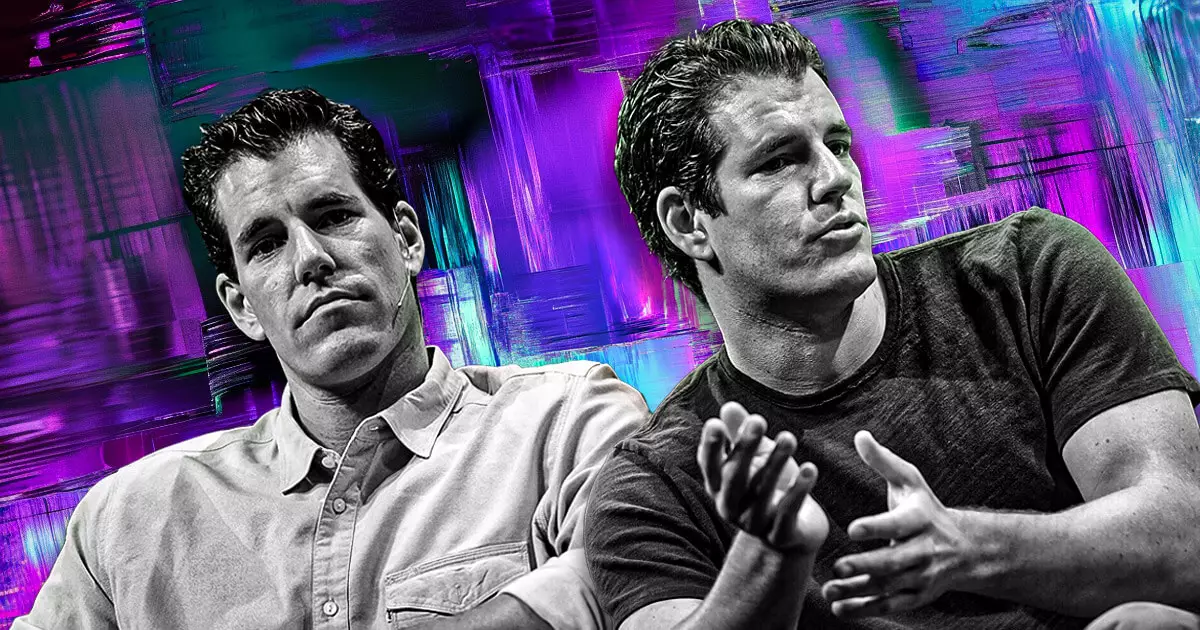

Gemini, the cryptocurrency exchange founded by the Winklevoss twins, is reportedly contemplating an initial public offering (IPO) within the year, according to Bloomberg News. This development highlights a significant moment for the crypto sector, particularly as it wrestles with regulatory scrutiny and market volatility. While no definitive plans have emerged, discussions with potential advisers indicate that Gemini is strategically evaluating its options. The decision to go public could not only reshape Gemini’s future but also potentially set a precedent for other cryptocurrency firms considering similar trajectories.

Political Dynamics and the Crypto Landscape

The current political atmosphere appears to play a pivotal role in Gemini’s decision-making process. Following the Trump administration’s favorable stance toward cryptocurrency, analysts like Bloomberg’s ETF expert, James Seyffart, anticipate that more crypto firms will pursue IPOs in the coming years. This optimism is further fueled by the Winklevoss twins’ substantial contributions of Bitcoin to Trump’s campaign, although they ultimately exceeded legal limits, highlighting the intertwined nature of finance and politics in this digital age. Such actions may signal a shift in institutional support for crypto investments, potentially enhancing their appeal to a broader investor base.

Despite the promising IPO potential, Gemini has faced its share of setbacks. The exchange recently concluded a settlement with the Commodity Futures Trading Commission (CFTC), agreeing to pay a $5 million fine due to allegations of misleading regulators during efforts to launch the first U.S.-regulated Bitcoin futures contract. This legal resolution signifies a commitment to transparency and compliance, which could reassure investors should the IPO move forward. However, the settlement underscores the ongoing challenges within the regulatory framework that digital asset exchanges must navigate.

Gemini’s direction is also influenced by its recent decision to withdraw from the Canadian market. This strategic retreat follows the lead of other exchanges, including competitors like Bybit and Binance, marking a trend in the industry where firms reassess their operations in light of heightened regulatory scrutiny in various jurisdictions. Conversely, Gemini has established a foothold in Singapore, securing a license that allows them to provide cross-border money transfers and digital payment services. This pivot showcases a proactive approach in chasing growth opportunities amidst regional regulatory fluctuations.

As Gemini contemplates its IPO, attention turns to whether this move will inspire other crypto companies to follow suit. Bullish Global, another digital asset exchange, is also exploring public listing options; this momentum could indicate a trend toward increased traditional market integration.

While the prospect of IPOs resonates with many, it remains essential for companies in the cryptocurrency sector to develop resilient strategies to embrace changing market conditions and regulatory standards. As the industry grows and matures, firms that successfully navigate these complexities may not only thrive but also instill greater confidence among prospective investors and users alike. Gemini stands at a crossroads, and its next steps could prove influential for the future of the entire crypto landscape.

Leave a Reply