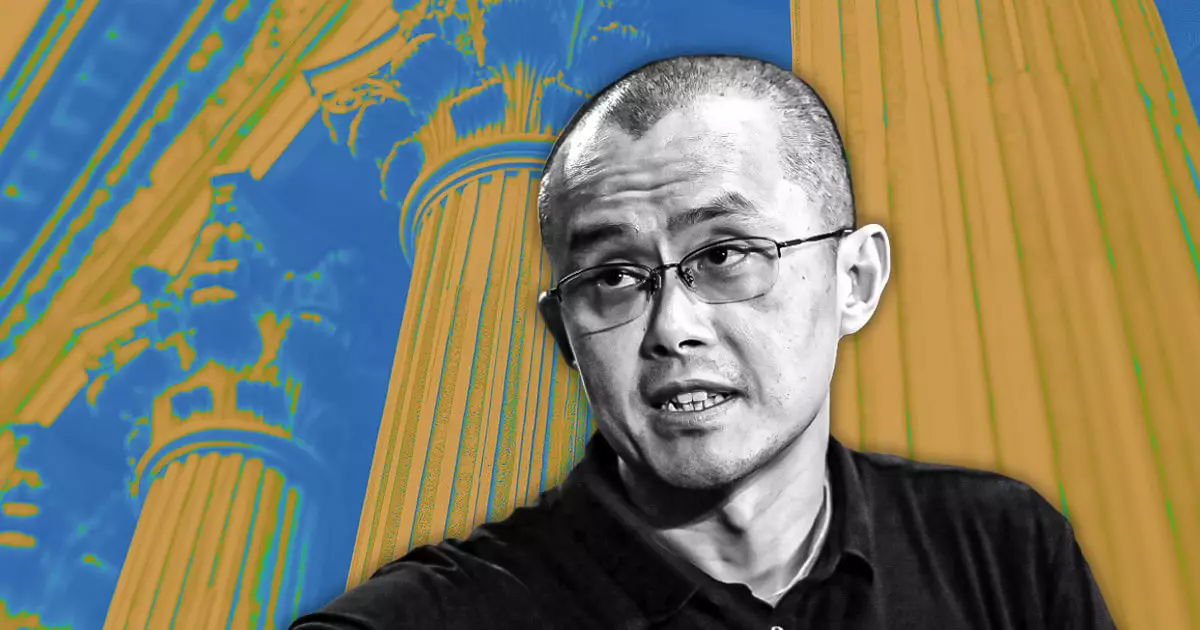

The crypto landscape is often rife with speculation, and Binance CEO Changpeng Zhao, commonly known as CZ, has found himself at the center of recent rumors regarding the potential sale of the cryptocurrency exchange. On February 17, he took to social media to explicitly deny allegations that Binance was in talks for a sale, labeling such claims as misinformation propagated by competitors. According to CZ, the conversation around a complete sale of Binance is unfounded and merely a distraction. He emphasized that any fluctuation in the company’s assets should not be misconstrued as a precursor to a sale, but rather as part of the regular adjustments in their treasury management.

While CZ firmly rejected the idea of a full acquisition, he did leave the door open for potential investment in the company through minority stakes. This suggests an interesting shift in strategy, where Binance could consider bringing in external investors for small ownership percentages in the future. The acknowledgment of ongoing interest from top investors indicates that Binance is not just a passive player in the market but is actively engaged in discussions about its future direction and financial strategies.

Furthermore, co-founder Yi He contributed to the dialogue by confirming that the exchange regularly encounters interest from various investors but made it clear that, at present, there are no intentions to dilute the ownership shares significantly. This position stresses a commitment to maintaining control while potentially benefiting from external investments for growth.

Understanding Asset Movements

The rumors about a potential sale intensified in light of recent asset movements within Binance’s holdings. Users observed significant reductions in the exchange’s crypto assets, sparking fears that this might indicate a sale of core holdings such as Bitcoin. However, Binance clarified that these adjustments were part of a routine re-evaluation process and not reflective of any financial instability. All user assets remain backed on a 1:1 basis, alleviating concerns regarding the platform’s liquidity and reliability.

The challenge of regulatory scrutiny and increased competition cannot be ignored, especially as Binance continues to hold its position as the world’s largest crypto exchange by trading volume. The environment has become increasingly competitive, with other centralized exchanges (CEXs) vying for market share. The very fact that Binance is considering if and how to evaluate minority stakes suggests a proactive approach to sustaining its market leadership amidst changing dynamics.

Analysts see the potential for minority investments as a strategic maneuver, allowing Binance to reinforce its financial standing without sacrificing autonomy. By possibly inviting institutional players into its fold, Binance may not only strengthen its capital base but also gain deeper insights into market trends and investor sentiment, allowing it to remain at the forefront of the cryptocurrency sector.

As Binance navigates through the choppy waters of speculation, regulatory challenges, and a competitive landscape, the insights shared by its leadership indicate that the company is strategically positioned for future growth. While the world awaits clarity on the possibilities of minority stake sales, the message is clear: Binance is not merely a passive entity in the crypto space; it is actively shaping its future, reinforcing its position, and keeping its options open for investment while staying true to its operational independence.

Leave a Reply