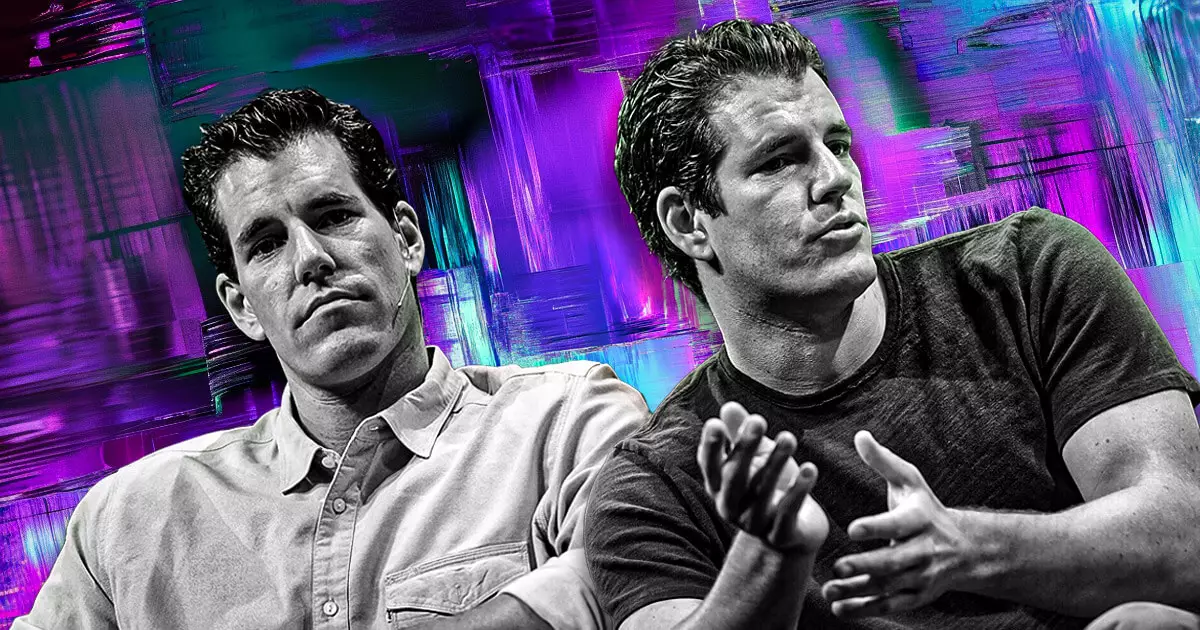

In a bold and contentious move, Gemini, one of the leading cryptocurrency exchanges in the United States, has announced its decision to cease hiring graduates and interns from the Massachusetts Institute of Technology (MIT). This resolution stems from the university’s recent reappointment of Gary Gensler, the former Chair of the U.S. Securities and Exchange Commission (SEC). Tyler Winklevoss, co-founder of Gemini, took to social media platform X to articulate the company’s stance, expressing that as long as MIT maintains its ties with Gensler, they would not entertain applications from any candidates affiliated with the university. This announcement reflects a significant shift in the relationship between the crypto industry and traditional academic institutions, rooted in the prevailing distrust of regulatory figures associated with frameworks that entrepreneurs deem restrictive.

Gensler’s reputation within the cryptocurrency community is notorious for being a staunch advocate for strict regulatory measures aimed at curtailing what he perceives as dubious practices within the sector. During his tenure at the SEC, he famously implemented regulations that many in the crypto sphere argue suppressed innovation and failed to distinguish between legitimate financial services and illicit activities. His recent return to MIT as a Professor of Practice at the Sloan School of Management has ignited outrage among crypto professionals, who view his teaching of cutting-edge topics like artificial intelligence and fintech as hypocritical given his regulatory history. This move is not only provocative but also indicative of a larger battle for the soul of innovation in academia versus the bitter pill of regulatory control.

The reactions to Gensler’s reappointment have been swift and severe. Cameron Winklevoss, Gemini’s other co-founder, condemned the decision as a blunder, characterizing Gensler as an “expert in failed public policies.” This sentiment has resonated through the crypto industry, sparking conversations about a possible collective distancing from academic institutions that align themselves with regulatory figures perceived as obstructive. Paradigm co-founder Matt Huang has notably commented on this evolving landscape, urging MIT-affiliated individuals in the crypto field to take action against the university’s decision. His call to arms signifies a mounting pressure on educational entities to reconsider their relationships with former regulators that the industry has labeled as antagonistic.

Caitlin Long, the CEO of Custodia Bank, has posed important questions regarding whether this moment could signify a broader shift in the crypto landscape. As the call for boycotts against law firms that employ former government regulators gains momentum, the implications for universities like MIT could be far-reaching. Long’s query about MIT alums pushing back against Gensler’s return reflects a rising tide of discontent that could reshape how the crypto sector interacts with academic institutions. This evolving dynamic presents an opportunity for a reimagined relationship where innovation is celebrated, rather than stifled.

As this story unfolds, it is evident that the rift between the cryptocurrency industry and regulatory figures will continue to deepen, ushering in a new era of advocacy and resistance against perceived oppressive academic and governmental frameworks. The relationship between academia and innovation in the cryptocurrency space will require careful navigation, as stakeholders seek to balance the pursuit of knowledge with a commitment to fostering an ecosystem conducive to progress and creativity.

Leave a Reply