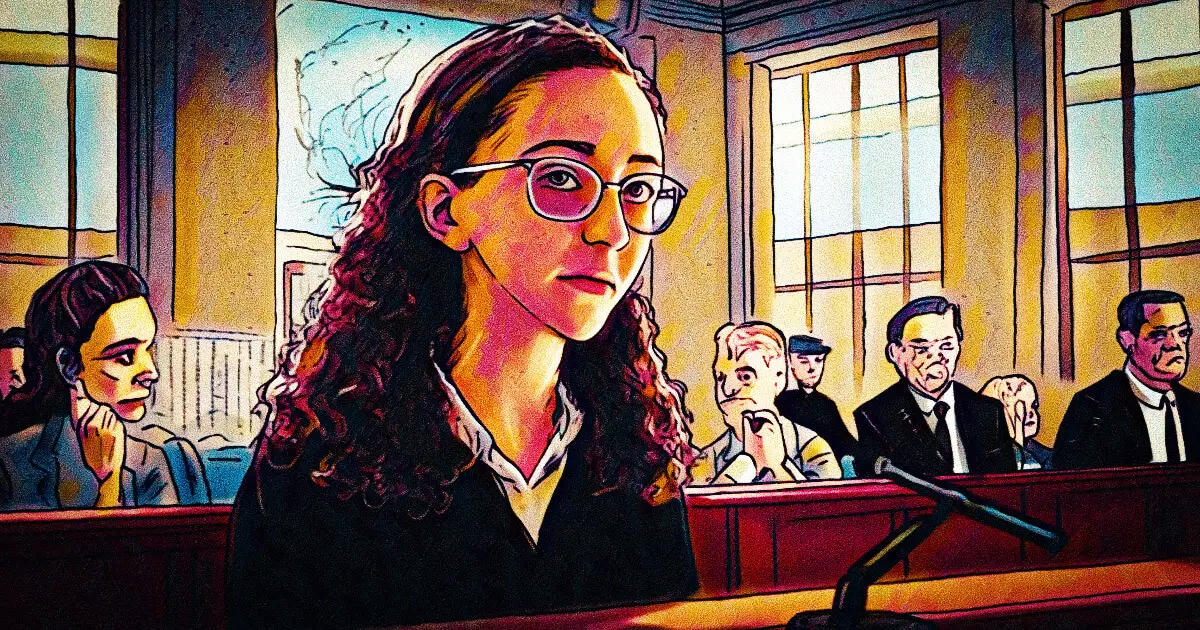

The dramatic implosion of FTX, once a titan of the cryptocurrency industry, sent shockwaves throughout financial markets. Central to this saga is Caroline Ellison, former CEO of Alameda Research and once associated with disgraced entrepreneur Sam Bankman-Fried (SBF). Recently, Ellison was sentenced to two years in prison and ordered to forfeit an astonishing $11 billion due to her involvement in the FTX crash. This ruling, delivered by the court on September 24, highlights the complex interconnections between personal relationships, corporate governance, and ethical decision-making.

Ellison’s legal representatives argued passionately against imprisonment, asserting that her testimony played a pivotal role in SBF’s conviction, which ultimately sentenced him to 25 years for multiple counts of fraud. They sought an alternative sentence emphasizing time served, claiming her cooperation with authorities was invaluable for understanding the systemic issues that plagued both FTX and Alameda Research. Their strategy hinged on portraying Ellison as a victim of SBF’s manipulations, insisting that her ethical compass was clouded by her personal ties to him.

In their court submission, the significance of Ellison’s cooperation was reinforced by John Ray, the current CEO of FTX managing its bankruptcy proceedings. His acknowledgment that her involvement aided in asset recovery demonstrated not only the tangible impacts of her testimony but also suggested her potential for rehabilitation. This narrative presented her as someone who, though complicit, acted under duress and actively sought to rectify the aftermath of the collapse.

The fallout from FTX extends beyond individual sentencing; it represents a critical moment for the cryptocurrency industry at large. FTX’s rise, characterized by aggressive marketing and substantial lobbying efforts, juxtaposed with its calamitous fall, raises urgent questions about regulatory oversight in the crypto market. The court cases against former executives like Ryan Salame, who was sentenced to 7.5 years, and the impending sentences for Nishad Singh and Gary Wang, reflect a growing pivot towards accountability in a sector that has long grappled with ambiguity around governance and ethical practices.

As the legal proceedings unfold, the crypto landscape may witness increased pressure for more stringent regulations and clearer guidelines to safeguard investors and promote sustainable practices. This crisis has revealed the perils of unchecked ambition, illustrating how rapid growth can lead to catastrophic failures when underpinned by inadequate oversight.

In reviewing the case of Caroline Ellison and her co-defendants, the broader legal and financial ecosystems must reflect on the lessons learned. Trust is paramount in financial dealings, yet the FTX debacle demonstrates how quickly it can erode. The saga underscores the need for a thorough reassessment of corporate ethics and personal responsibility, particularly in high-stakes environments like cryptocurrency trading.

The ramifications of Ellison’s actions and the judgments against her peers underscore a critical juncture for the industry. This episode will likely serve as a cautionary tale, prompting discussions on ethical leadership, regulatory frameworks, and the responsibilities of executives in navigating personal and professional dilemmas. Ultimately, restoring trust in such industries may require not just regulatory changes but also a fundamental shift in corporate culture, placing ethical considerations at the forefront of business operations.

Leave a Reply