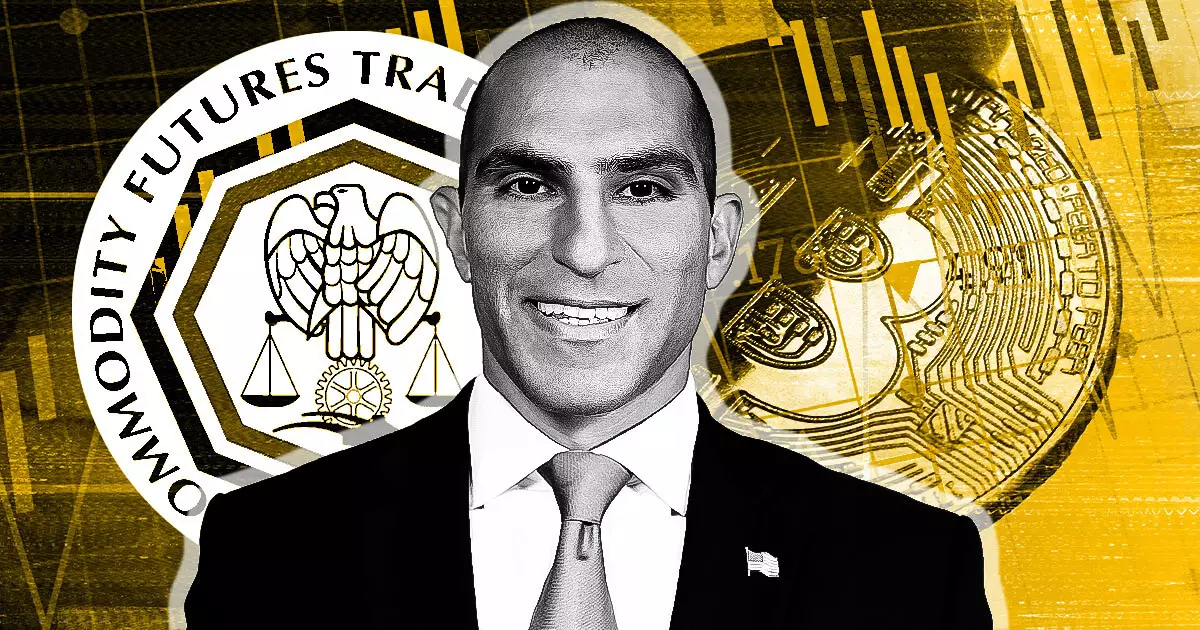

The recent Senate Agriculture Committee hearing shed light on the Commodity Futures Trading Commission’s (CFTC) willingness to step up as a primary regulator for cryptocurrencies. This shift in focus could mark a significant paradigm shift in the oversight of digital assets. In response to Senator Roger Marshall’s inquiry about the CFTC taking the lead in regulating digital assets, CFTC chair Rostin Behnam expressed openness to the idea. Behnam highlighted the agency’s capacity, expertise, and experience in handling such a responsibility. However, he cautioned that redefining securities and commodities would be necessary for the CFTC to assume this role.

Collaboration Over Conflict

Behnam’s stance on collaboration between the CFTC and the Securities and Exchange Commission (SEC) was a key highlight of the hearing. While he opposed the idea of the SEC unilaterally deciding on asset jurisdiction, Behnam emphasized the history of cooperation between the two agencies in defining assets in grey areas. This collaborative approach, spanning over five decades, has been crucial in addressing regulatory ambiguities and ensuring comprehensive oversight. Behnam’s emphasis on joint efforts to resolve conflicting asset designations reflects a commitment to mitigating legal uncertainties in the crypto space.

One of the core objectives outlined by Behnam during the hearing was the urgent need to introduce tokens and contracts into regulated markets. By doing so, the CFTC aims to minimize investor risks associated with unregulated crypto activities. Behnam’s assertion that a significant portion of the crypto market should fall under the CFTC’s oversight underscores the importance of regulating this rapidly evolving space. With a majority of crypto assets eluding classification as securities, Behnam’s call for regulatory action resonates as a crucial step towards establishing market integrity.

The financial aspect of expanding the CFTC’s regulatory mandate was a focal point of the hearing. Behnam highlighted the need for an initial budget of at least $30 million in the first year and $50 million in the following year to operationalize an effective regulatory regime. These funds would be allocated towards staffing, administration, and IT infrastructure, with user fees from registrants offsetting the requested budget. Behnam’s acknowledgment of Senator Cory Booker’s concerns regarding the urgency of regulatory action underscores the pressing need to combat fraud and manipulation in the crypto space.

The CFTC’s potential transition to a primary regulator for cryptocurrencies represents a significant step towards comprehensive oversight of digital assets. Behnam’s vision for a collaborative regulatory framework, coupled with the agency’s focus on minimizing investor risks, points towards a proactive approach to crypto regulation. By addressing legal uncertainties, securing necessary funding, and emphasizing the urgency of regulatory action, the CFTC aims to chart a new course in the regulation of cryptocurrencies.

Leave a Reply