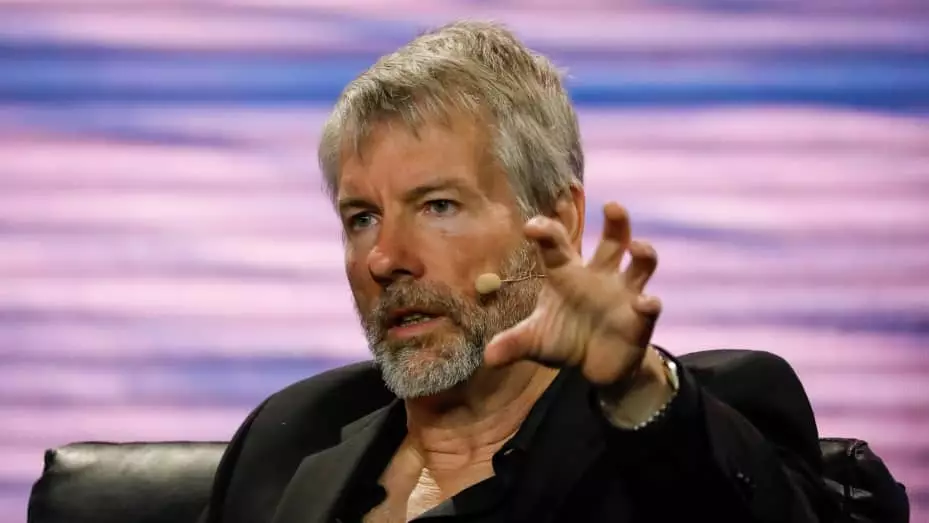

Michael Saylor, the co-founder and executive chairman of MicroStrategy, recently declared that he and his company would continue to purchase Bitcoin indefinitely. In a recent Bloomberg interview, Saylor emphasized his unwavering commitment to holding onto his and his firm’s BTC holdings, even as they have seen an unrealized profit of approximately $4 billion. According to Saylor, Bitcoin serves as both an exit strategy and the most robust asset in the market.

Despite Bitcoin’s emergence as a trillion-dollar asset alongside tech giants like Apple, Google, and Microsoft, Saylor pointed out that it is not a company, but rather a digital currency competing against traditional asset classes such as gold and the S&P stock market index. With an eye on its potential to reach $10 trillion or even $100 trillion worth of capital, Saylor believes that Bitcoin’s primary competitors are gold, the S&P index, and real estate, which are all considered massive stores of value.

Saylor argues that capital will continue to flow from gold and other asset classes into Bitcoin due to its technical superiority. He firmly believes that selling Bitcoin to buy into other assets would be a mistake, as Bitcoin has proven itself to be the winner in terms of long-term value and potential growth.

In addition to his bullish stance on Bitcoin, Saylor has also expressed enthusiasm for the recent launch of Bitcoin exchange-traded funds (ETFs), likening them to the historic creation of the S&P 500 fund. Having started accumulating BTC in 2020, MicroStrategy became the first publicly traded company to stockpile Bitcoin. With their latest purchase of 850 BTC in January, the company’s total holdings stand at 190,000 BTC, valued at over $10 billion.

Saylor has forecasted a surge in Bitcoin demand by 2024, a prediction that seems to be coming to fruition. Currently, the demand for BTC from spot Bitcoin ETFs is nearly ten times higher than the available supply from miners. This trend indicates a growing interest in Bitcoin as a valuable asset and a reliance on it as a store of value in the future.

Michael Saylor’s unwavering commitment to Bitcoin as a long-term investment and store of value exemplifies his confidence in the digital asset’s potential for growth and stability in the ever-evolving financial landscape. His strategic approach to accumulating and holding Bitcoin suggests a calculated risk that has paid off handsomely for MicroStrategy thus far, positioning the company as a pioneer in the adoption of cryptocurrencies within traditional financial markets.

Leave a Reply