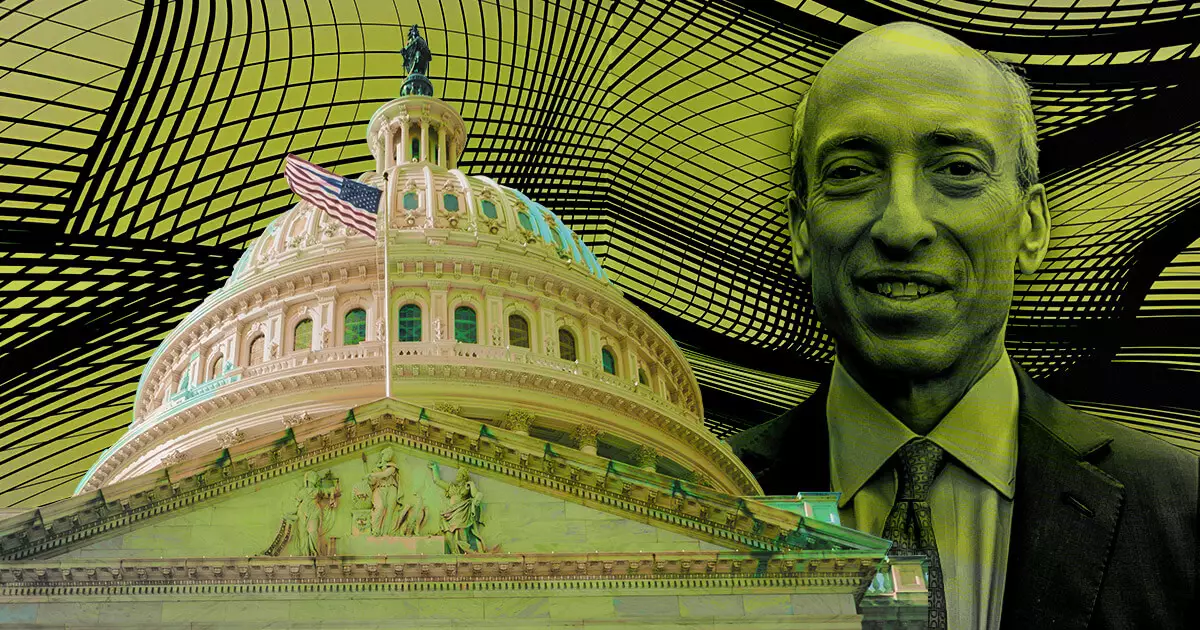

A recent development has left the U.S. Securities and Exchange Commission (SEC) in turmoil. U.S. Congressman Warren Davidson, with the support of House Majority Whip Tom Emmer, has taken a bold stance by advocating for the firing of SEC Chair Gary Gensler in 2024. The rationale behind this move is rooted in allegations of corruption and abuses of power. Davidson’s actions come as escalating tensions between the SEC and the digital asset sector have dominated the landscape throughout 2023.

A Strained Relationship

Davidson is primarily concerned with Gensler’s enforcement-first regulatory approach, which he believes has strained the SEC’s relationship with the digital asset industry. To address these concerns, Davidson introduced the SEC Stabilization Act earlier this year. The Act proposes a restructuring of the SEC that would remove Gensler from his position, citing a “long series of abuses” under his leadership.

The SEC Stabilization Act seeks to add a sixth commissioner and an Executive Director to oversee day-to-day operations. The proposed restructuring aims to redistribute powers, with all rulemaking, enforcement, and investigation authorities remaining with the commissioners. By preventing a single political party from holding more than three commissioner seats, the Act aims to safeguard U.S. capital markets from potential political agendas.

Calling for reform, Davidson emphasized the need to protect U.S. capital markets from what he perceives as a tyrannical Chairman. He firmly believes it is time for Gary Gensler to be fired as Chair of the SEC. Emmer echoes Davidson’s sentiments, emphasizing the necessity for clear and consistent oversight in the interest of American investors and the industry, rather than political maneuvering.

Social Media Support

In addition to legislative efforts, supporters of Davidson’s cause have taken to social media to voice their opinions. Tweets from various individuals highlight the desire for Gensler’s removal and the passage of the SEC Stabilization Act. One tweet focuses on ending the accredited investor rule, claiming it protects the interests of a privileged class. Another tweet accuses Gensler’s SEC of favoring Wall Street over Main Street and endorses Davidson’s bill as a means to hold the SEC accountable.

These recent developments, along with the introduction of the SEC Stabilization Act, mark a critical juncture in the ongoing dialogue surrounding regulatory approaches and accountability within the U.S. financial regulatory framework. The SEC Chair’s position holds significant influence over the digital asset sector and the wider financial industry, making the debate around Gensler’s potential dismissal a matter of great importance.

As tensions continue to escalate, the fate of SEC Chair Gary Gensler remains uncertain. The calls for his removal, led by U.S. Congressman Warren Davidson and supported by House Majority Whip Tom Emmer, highlight a growing dissatisfaction with Gensler’s leadership. Whether the SEC Stabilization Act will gain enough traction to effect the desired restructuring and removal of Gensler remains to be seen. The coming months will be instrumental in shaping the future of the SEC, the digital asset industry, and the broader financial regulatory landscape in the United States.

Leave a Reply