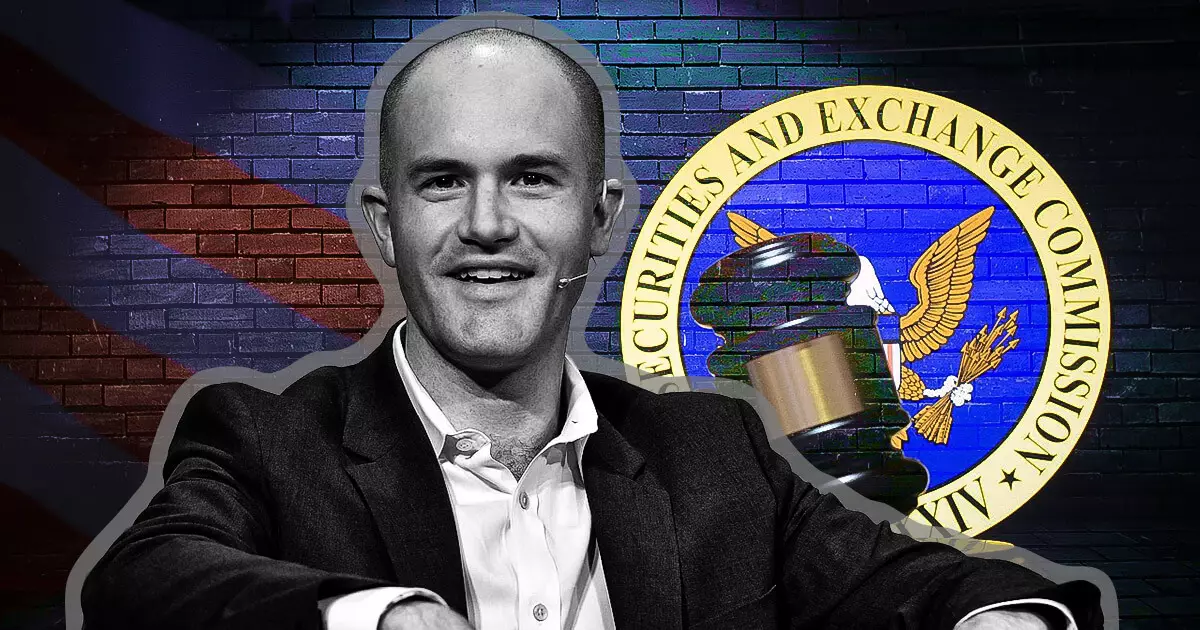

Brian Armstrong, the CEO of Coinbase, has made a bold statement in response to the ongoing regulatory tension between the cryptocurrency sector and government oversight. Armstrong announced that his exchange would discontinue working with law firms that engage former regulatory officials, particularly those linked to actions he labels as “unlawful” against the crypto industry. This declaration, made on December 3rd via social media, underscores Coinbase’s frustration with existing regulatory frameworks and the individuals who have contributed to what they perceive as hostile regulatory practices.

The catalyst for Armstrong’s remarks appears to be the recent hiring of Gurbir S. Grewal, the former director of the SEC’s Division of Enforcement, by the law firm Milbank. The Coinbase CEO publicly addressed this development, indicating that Milbank would no longer be a partner for Coinbase if they continue to recruit individuals associated with what he deems unethical regulatory practices. The assertion that consulting firms should reconsider their associations with such figures reflects a growing sentiment among cryptocurrency advocates aiming to reshape the regulatory landscape.

Armstrong has been vocally critical of the former SEC administration under Gary Gensler, describing its efforts as “unlawful” and detrimental to the growth of the crypto industry. He argues that these regulatory actions flourished under a guise of compliance yet lacked clarity, leaving crypto industry stakeholders in a lurch. Armstrong’s claim that senior officials at the SEC could not simply follow orders stands as a significant departure from the traditional narrative in regulatory compliance, which often emphasizes adherence to agency directives without personal accountability.

Another critical aspect of Armstrong’s commentary is his stance on ethics within the regulatory framework. He pinpointed specific individuals, such as Grewal, as being complicit in advancing policies that adversely affect the integrity and innovation potential of the crypto sector. Despite his hard stance, Armstrong advocates for measured responses rather than “permanently canceling” individuals. He encourages the community to leverage their collective influence by withdrawing support from firms that employ individuals who have not advocated for their interests.

Armstrong’s approach reflects the escalating tensions between the crypto industry and regulatory authorities. Coinbase is frequently at the forefront of legal disputes, and the company’s leadership is under considerable pressure to navigate these treacherous waters skillfully. The push for clear and constructive regulatory guidelines is becoming increasingly urgent as the industry seeks to thrive amidst a backdrop of uncertainty.

The trend of former regulators transitioning to private practice, as evidenced by Grewal’s move to Milbank, serves as a reminder of the delicate balance between regulation and fintech innovation. It raises questions about the ethical implications of such transitions and what this means for future collaborations between legal firms and the cryptocurrency sector. Armstrong’s call to action not only represents a decisive stance but also acts as a rallying point for others in the industry to advocate for fairness and transparency in regulatory practices.

Armstrong’s declaration marks a significant chapter in Coinbase’s ongoing struggle for regulatory clarity and fairness. By establishing boundaries with legal partners, he aims to foster an environment where innovation is prioritized, and those complicit in punitive regulatory tactics are held accountable.

Leave a Reply