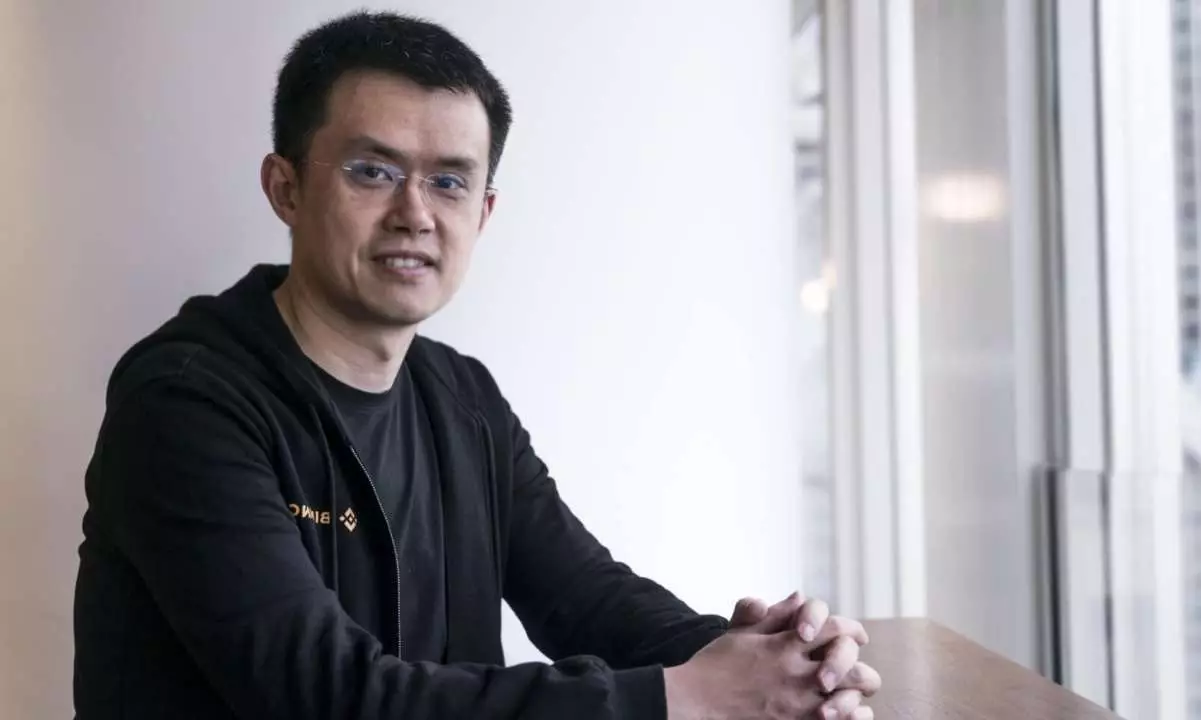

In the world of cryptocurrency, security breaches are a constant concern as hackers devise increasingly sophisticated methods to exploit vulnerabilities. A recent incident involving the Bybit exchange has brought these concerns to the forefront, especially after the once-celebrated Safe Wallet suffered a massive compromise, leading to the theft of nearly $1.5 billion worth of assets. Changpeng Zhao, the former CEO of Binance, has openly criticized Safe Wallet’s response to the hack, calling the follow-up report both vague and inadequate. This incident not only raises questions about Safe Wallet’s security protocols but also highlights the broader implications for the cryptocurrency market at large.

As reported, the breach was primarily traced back to compromised credentials linked to a developer machine within Safe Wallet. Forensic investigations stated unequivocally that the incident did not stem from flaws within Bybit’s infrastructure but rather from failures in the security practices undertaken by Safe. This revelation prompts an important discussion about the cybersecurity measures that should be in place to protect sensitive developer credentials. The fact that a single machine could serve as a gateway for such extensive unauthorized access calls into question the effectiveness of current security protocols within crypto wallet infrastructures.

Critique of the Response

Zhao’s critique of Safe Wallet’s update is particularly noteworthy; his assertion that the statement raised “more questions than answers” signals a need for transparency in future communications regarding security incidents. Specifically, his inquiries into the methods that might have been employed by the attackers—such as social engineering or potential malware—reflect a desire for clarity that many stakeholders in the cryptocurrency space share. Furthermore, Zhao’s probing into whether proper verification methods were followed during the signing process underscores the crucial need for robust verification processes to mitigate such risks.

Technical Insights into the Hack

An alarming aspect of the breach involved the use of malicious JavaScript code, which was skillfully masked within Safe Wallet’s Amazon Web Services environment. The forensic audit revealed that this code was meticulously designed to trigger only during specific transaction approvals. Moreover, the manner in which the attackers removed their code shortly after executing the exploit indicates a high level of planning and technical acumen. The incident exemplifies a growing trend—where attackers employ complex scripts alongside social engineering tactics to manipulate the behavior of signers or developers.

In the wake of the hack, Bybit initiated a series of measures to restore confidence and stabilize operations. By borrowing 40,000 ETH from Bitget to address immediate withdrawal concerns, the exchange demonstrates a proactive approach to mitigating the fallout from the incident. Furthermore, CEO Ben Zhou’s reassurances regarding the backing of client assets suggest a commitment to transparency and accountability in the wake of adversity. These efforts are vital, not just for regaining trust among users but also for setting examples for others in the cryptocurrency space regarding crisis management and resilience.

Implications for Future Security Practices

As cryptocurrency continues to gain popularity, the need for fortified security measures becomes ever more pressing. The incident involving Bybit and Safe Wallet provides invaluable lessons on the critical importance of securing developer environments and the infrastructures of exchanges. Stakeholders must prioritize the implementation of enhanced multi-factor authentication, keen monitoring of access protocols, and a culture of security awareness that extends beyond mere compliance. The cryptocurrency community must evolve its security frameworks to effectively combat the sophisticated threats posed by cybercriminals.

The breach at Bybit serves as a stark reminder of the vulnerabilities that exist within the cryptocurrency ecosystem. Through rigorous analysis of events such as these—alongside calls for greater transparency and accountability—we can formulate a stronger security posture that safeguards against future attacks. As the industry grapples with these challenges, the onus is on all entities involved, from exchanges to wallet providers, to collectively adopt a more disciplined approach toward cybersecurity, ensuring that trust and security remain foundational to the crypto experience.

Leave a Reply