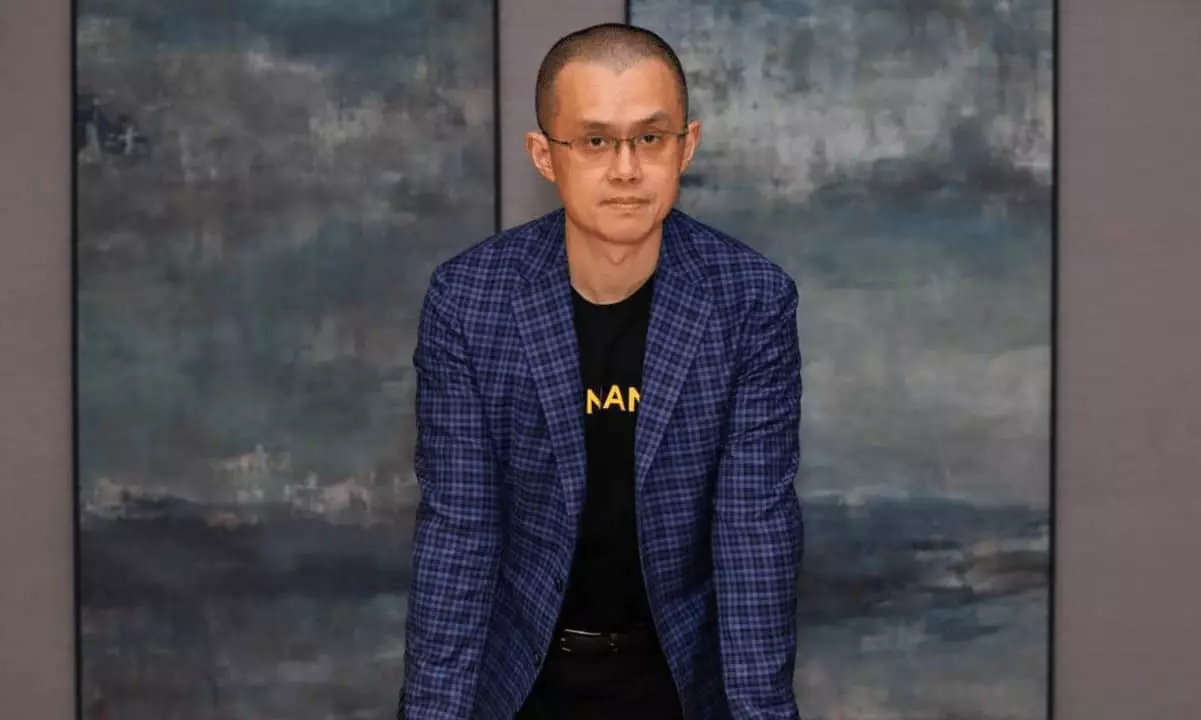

As cryptocurrencies become a significant part of many people’s portfolios, the conversation around digital asset inheritance has taken center stage. Changpeng Zhao, the founder of Binance, has become a vocal advocate for the need to integrate a “will function” across crypto platforms. His statements raise a critical question: how well are we prepared to handle the transfer of assets when the unexpected happens? Given the staggering statistic that over $1 billion in crypto is lost each year simply because individuals do not communicate their holdings, it’s evident that current systems are inadequate. This challenge not only underscores a growing need for innovation but also highlights a major oversight in the way we manage digital wealth.

The Emotional Toll of Inheritance Gaps

Inheritance is not just about the transfer of assets; it’s deeply personal. The burden placed on families during emotional times can be exacerbated by failure to access a loved one’s cryptocurrency. When traders pass away without sharing crucial information about their portfolios, the fallout can be catastrophic. It’s frustrating and heart-wrenching to think of the loved ones left searching for information, often only to find their family member’s hard-earned digital assets stranded without a map. Such a practice is not just negligent; it can lead to forfeited wealth. The proposal for a will function resonates because it speaks to the obligation we have toward our loved ones.

Regulatory Support for Minors: Progress or Pitfall?

CZ’s suggestion to permit minors to hold accounts that can receive but not trade crypto may indeed be a step forward, giving families a legal footing to pass on digital assets. However, it raises questions about the avenues through which these assets are managed and monitored. Do we trust our youngest users to engage with a complex and often volatile market? While it’s essential to prepare the next generation responsibly, the implementation of such measures should come with robust educational resources to ensure minors are equipped and educated.

Binance Leads the Charge but Is It Enough?

Binance has taken commendable strides by introducing its emergency contact feature, which allows users to pre-designate individuals who will potentially inherit their holdings. Actions like these can lessen the strain felt by families during bereavement. However, I can’t help but wonder: is this approach too simplistic? Competitors like Coinbase and BitGo employ more traditional estate planning methods, which, despite being cumbersome, incorporate legal safeguards that may provide an added layer of protection for heirs. In the world of crypto, where volatility reigns, a blend of progressive thinking and established legal frameworks might be the best course.

The Bigger Picture: Shaping Future Practices in Crypto

Zhao’s forward-thinking attitude is encouraging, especially in an industry that often appears chaotic and unregulated. The industry must respond decisively to these inheritance gaps before they become a legal and ethical crisis. With millions at stake, the crypto world must adopt comprehensive systems to ensure wealth can transfer to rightful heirs without confusion or loss. In doing so, we not only respect the wishes of the departed but also demonstrate a commitment to creating a sustainable crypto ecosystem that priorities responsibility and transparency.

Leave a Reply