Ethereum is not just another cryptocurrency; it represents a technological leap that promises to redefine traditional paradigms. As it stands poised for either significant growth or a sharp correction, investors are buzzing with combined excitement and skepticism. The recent surge in Ethereum’s price, surpassing $2,700, has generated feverish anticipation. However, this optimism is tempered by the reality of market volatility.

The current trajectory of Ethereum seems to be an illustration of human psychology—exciting yet terrifying. Much like the rollercoaster of the stock market, digital currencies invoke a cocktail of emotions among traders. The fact is, while Ethereum has reclaimed a significant position with a 50% surge in a matter of days, it requires a more critical perspective on both the short-term metrics and long-term viability.

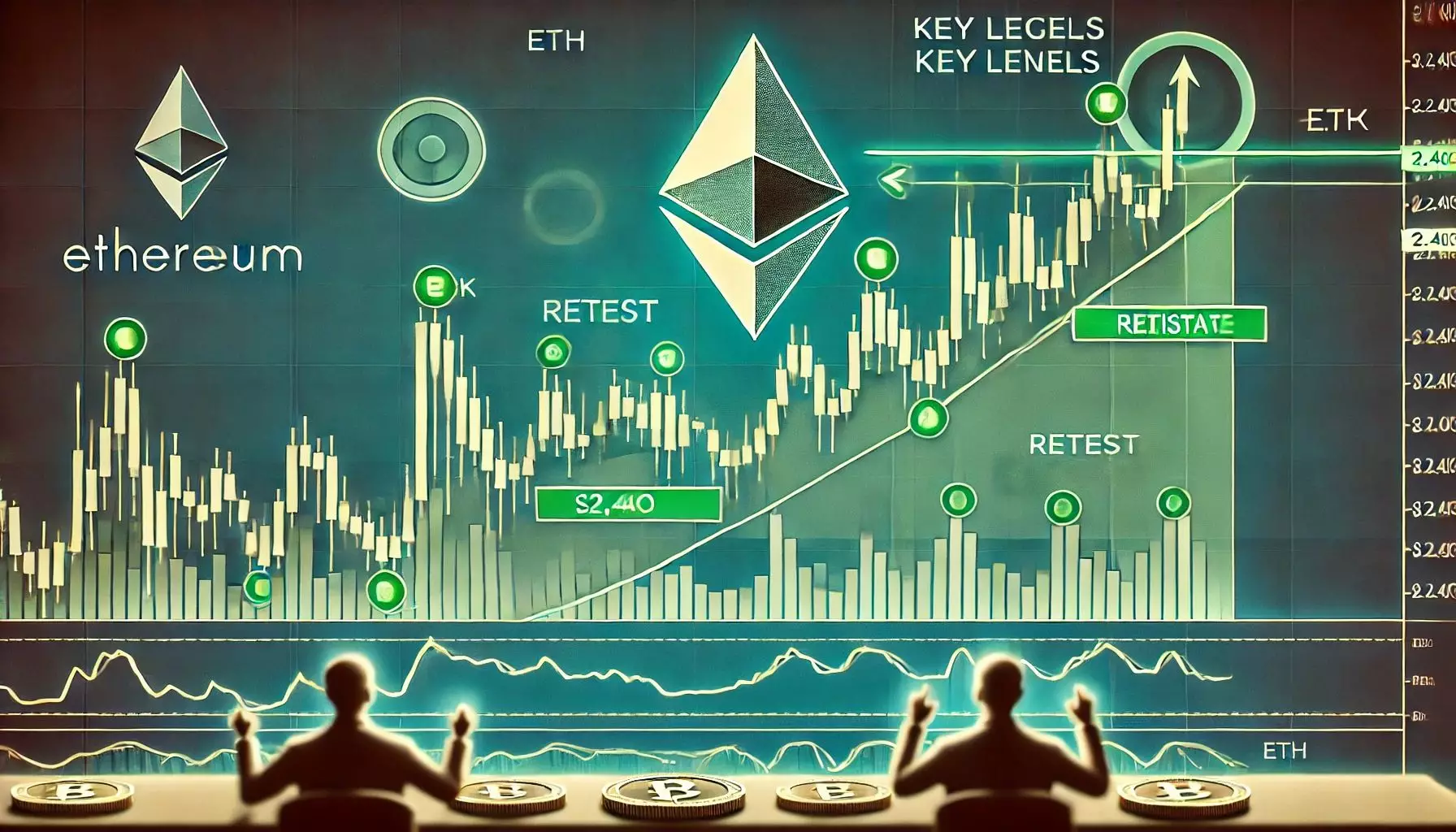

The Crucial Levels to Watch

Analysts, particularly veteran trader Daan, emphasize the significance of key price levels in this ongoing saga. The $2,400 area stands as a critical threshold that traders are keenly observing. Should Ethereum manage to hold above this price point, the bulls may indicate their strength. However, a fall below this support not only instinctively raises red flags but might also lead to a painful descent towards the $2,200 mark.

It’s worth noting that market participants are not just watching these metrics; they are also interpreting them. Higher open interest in the derivatives market is causing concern among astute traders, making many hesitant to enter long positions just yet. Undoubtedly, the intricate dance of trading psychology is at play: excitement drives impulsive buying, but fear of loss can instigate waves of selling.

Consolidation or Correction? The Market’s Crossroad

The terminology surrounding Ethereum’s fluctuation—’consolidation’ versus ‘correction’—is critical. While a robust consolidation phase can set the stage for the next upward movement, an unwelcomed correction could signal significant weakness. Daan aptly points out that if Ethereum loses momentum around the $2,400 threshold, the implications could be more severe than they seem on the surface.

A correction might be construed as natural, particularly after such explosive gains. However, what happens next is pivotal. Should the price stagnate within the range of $2,400 to $2,700, it could form a new trading channel, providing both bulls and bears an opportunity to recalibrate their positions and sentiments.

The Broader Altcoin Market’s Response

The dynamics of Ethereum directly influence a multitude of altcoins, which have largely been languishing in the shadow of Bitcoin and Ethereum for some time. As Ethereum surges, analysts are cautiously optimistic about an “altseason”—a phase where altcoins mimic or even exceed the gains of major assets.

However, for this optimism to materialize, Ethereum must exhibit strength and resilience. A hiccup in ETH’s performance could spell doom for lesser-known cryptocurrencies, as investor confidence may wane. A cascading effect in the market could ensue if traders slip into defensive postures, which would inevitably taper the enthusiasm surrounding the entire crypto space.

The Historical Context of Ethereum’s Cycles

History is a remarkable teacher, impacting our perception of the future. Ethereum’s recent peaks and valleys closely mirror its past patterns. As we remember the euphoric highs from 2021, the underlying principles of investor behavior remind us of the cyclical nature of such markets. Past trends of dramatic corrections followed by massive recoveries loom large in traders’ minds.

The challenge lies in deciphering whether current conditions will lead to a repeat of such cycles. While the overwhelming sentiment may currently lean towards bullishness, it’s crucial to see beyond the veil of optimism. Ethereum is delicately balanced on a precipice; even a minor shift in macroeconomic indicators or regulatory sentiment could send it tumbling.

Keeping an Eye on the Bigger Picture

While short-term projections may dominate conversations, focusing solely on immediate price movements risks losing sight of the bigger vision. Ethereum’s transformative potential in sectors such as decentralized finance (DeFi) and non-fungible tokens (NFTs) is enormous and far-reaching. It signifies a disruptive force that could reshape financial systems for years to come.

However, this transformation is intertwined with the cryptocurrency’s volatility. Investors must grasp the bigger picture while also employing strategies that account for sudden market shifts. The significance of disciplined risk management has never been more crucial for navigating the treacherous waters of cryptocurrency trading.

Ethereum finds itself in a maelstrom of volatility, excitement, and potential. The next steps will likely dictate not only its future trajectory but also the health of an entire digital asset ecosystem, carrying implications for ardent supporters and skeptics alike. As we stand on the threshold of uncertainty, the next few weeks will indeed be critical.

Leave a Reply