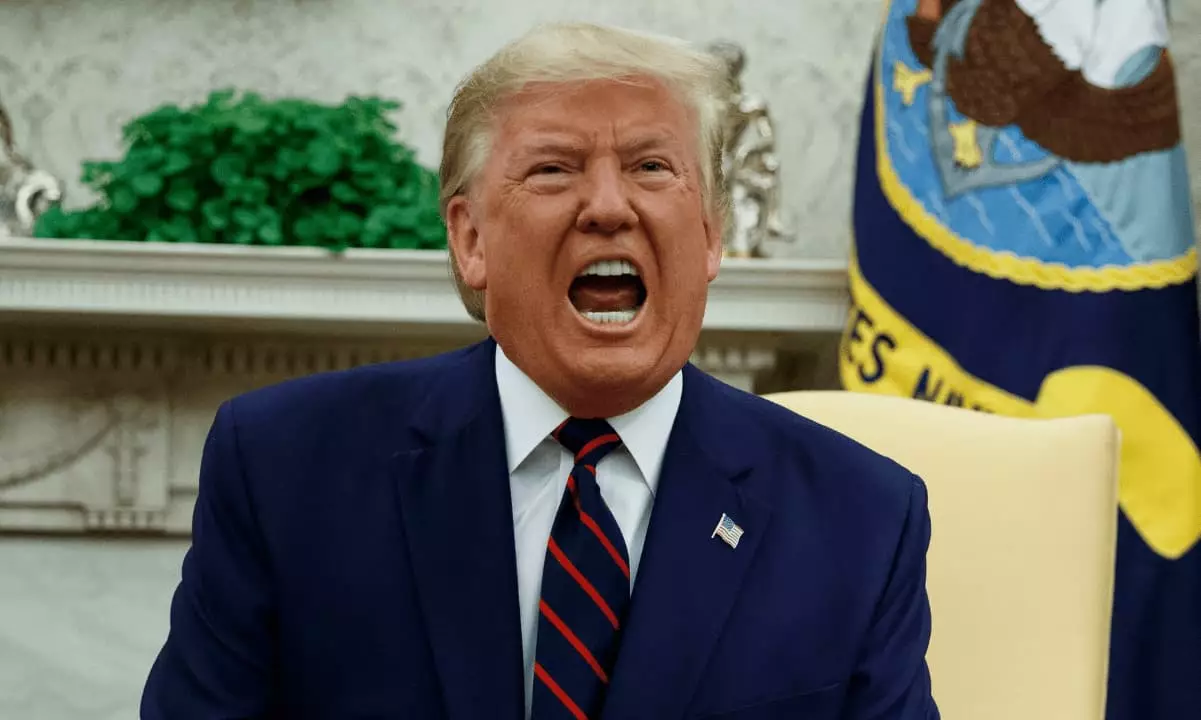

The recent inquiry launched by top House Democrats into President Donald Trump’s cryptocurrency ventures has unveiled a murky and controversial intersection of politics and digital finance. While some might argue that political fundraising through crypto is a modern evolution of campaign financing, the implications of this inquiry suggest a much more sinister narrative. The investigation highlights serious concerns over potentially illegal fundraising activities, foreign influence, and the abuse of political power. The core issue lies in the suspicion that these financial ventures may operate under a guise of legitimacy while exploiting loopholes to facilitate corruption.

Funding formats have drastically evolved, and platforms like WinRed are at the forefront of this shift. However, what emerges is the troubling possibility that political figures can harness the anonymity and volatility of cryptocurrency to distract from their questionable practices. This inquiry, led by House Democrats including Gerald Connolly and Jamie Raskin, seeks to unravel the layers surrounding Trump’s fundraising methods. Their letter to Treasury Secretary Scott Bessent is not just a formal request; it’s a clarion call for ethical standards in a political landscape often overshadowed by opportunism.

Suspicious Transactions and Lack of Accountability

The fundamental aspect of this inquiry revolves around the requested Suspicious Activity Reports (SARs) from relevant parties related to Trump’s ventures. What stands out are the alarmingly high stakes surrounding entities like the Trump family’s World Liberty Financial and the controversial WLFI token sale. After falling short of forecasted fundraising targets, it raises eyebrows when a substantial $75 million purchase emerges from Justin Sun, an individual already under the scrutiny of the SEC.

The circumstances invite critical skepticism. Could this transaction indicate a deeper web of complicity, wherein dubious transactions camouflage themselves behind the pretense of legitimate fundraising? In an era where transparency is paramount, the anonymous nature of cryptocurrency transactions fuels a narrative of potential corruption. The fear is not merely abstract; it reflects the tangible risks associated with foreign influence in U.S. politics, where recent revelations suggest that foreign nationals have raked in substantial profits at the expense of domestic investors—raising the specter of insider trading and fraudulent schemes.

Foreign Influence: A Game-Changer in American Politics

At the core of the concerns raised by Connolly and his colleagues is the notion of foreign influence infiltrating U.S. political processes. It is unsettling to consider how foreign investors, particularly those allegedly tied to China, could manipulate markets and politics through anonymity offered by cryptocurrencies. With 80% of the TRUMP meme coin’s supply controlled by President Trump’s associates and profits exceeding $100 million, the potential downstream repercussions are significant. The implications go beyond mere financial transactions; they signal a threat to the foundations of democracy, where policy decisions could be swayed by foreign entities benefitting from these digital assets.

Recent developments reveal the exploitation of such systems for substantial financial gain, raising alarms on national security and ethical governance. Even Trump’s announced plans for a stablecoin, USD1, connect him to further financial entanglements with international actors. The involvement of foreign investment, especially discussions surrounding a $2 billion investment from an Abu Dhabi-backed fund in the Binance exchange, underscores the intricate tangles of business, politics, and foreign engagement.

The Need for Regulatory Clarity

With this inquiry gaining momentum, the demand for regulatory clarity in cryptocurrency fundraising has never been more pressing. The proposals from Democrats, including a bill by Rep. Ritchie Torres for prohibiting sitting presidents and Congress members from profiting off digital currencies, speak volumes about the urgent need for ethical guidelines in political financing. As stakeholders feel the heat of increased scrutiny, the political landscape is bound for substantial changes.

Moreover, the failed GENIUS Act, aimed at tightening the regulation of stablecoins, stands as a testament to the complexities faced in balancing innovation with accountability. Such obstacles serve only to further entrench the argument for comprehensive regulatory frameworks that hold public officials to higher standards. The stakes of mismanaged influences in political fundraising cannot be overstated—transparency, integrity, and public accountability should be non-negotiable.

As this inquiry unfolds, it beckons a pivotal moment for American politics, where the question of whether cryptocurrency can coexist within a framework of ethical governance looms large. The challenge remains: will we allow our political systems to be shaped by individuals seeking personal gain, or will we assert the necessity for clearer lines of accountability? Time will tell, but the conversation is beginning, and it may lead to enduring transformations in how political finance operates in the digital age.

Leave a Reply