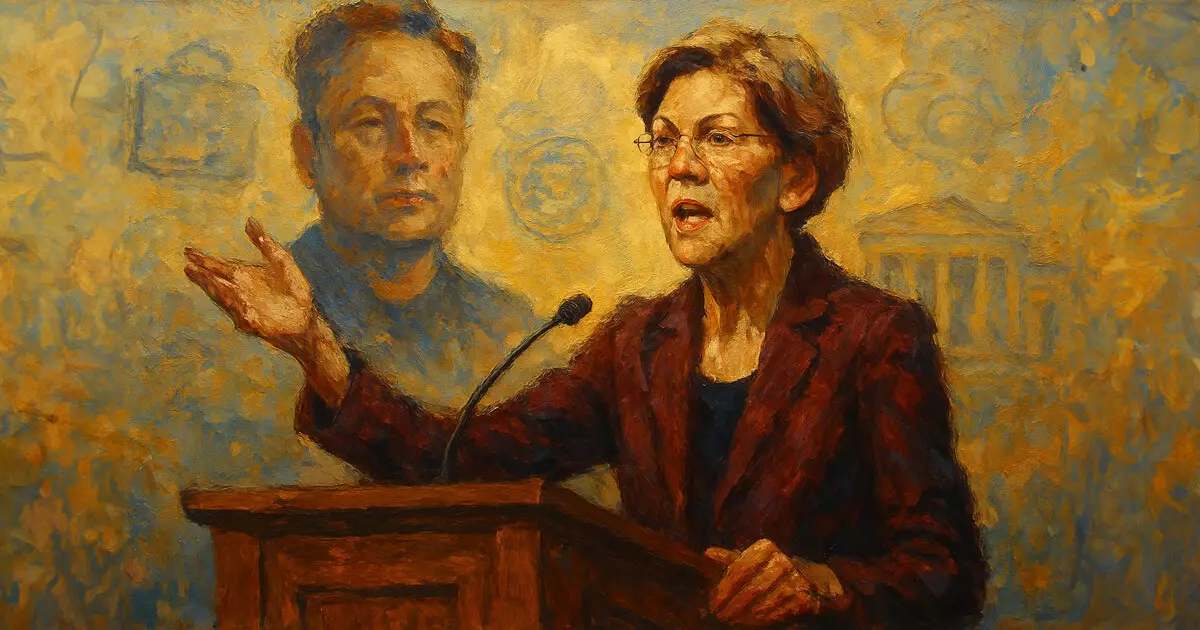

In the convoluted world of American governance, a peculiar entity known as Special Government Employees (SGEs) has attracted attention and criticism. Senator Elizabeth Warren’s newly proposed bill, the Special Government Employee Ethics Enforcement and Reform (SEER) Act, emerges as a response to these concerns. As the lines between public service and private gain blur, Washington faces a dilemma that highlights the perilous dance of transparency and accountability—especially when influential figures like Elon Musk wade into these murky waters. The reality is that SGEs, who can work up to 130 days a year without disclosing financial interests unless they hit a certain pay grade, open the door to potential ethical dilemmas.

The Wolf Among the Sheep

At the heart of the inquiry is the question: Should figures like Musk, who are intricately linked to the private sector and also remain influential in federal decision-making, be allowed to navigate the grey areas of ethics unchallenged? Warren argues that allowing such individuals to profit from government deals while escaping mandatory disclosures is reckless. Here, we see an alarming reality: people benefiting from the government must be held to the same ethical scrutiny as full-time officials. The SEER Act’s introduction reflects a growing discontent among lawmakers and the public, questioning whether certain individuals are simply wolves in sheep’s clothing, exploiting loopholes for personal gain.

Backed by the People

The coalition supporting the SEER Act includes advocacy groups such as Public Citizen and Citizens for Responsibility and Ethics in Washington (CREW). Their backing showcases a collective yearning for integrity in governance, especially when corporate interests have begun to overshadow public service. With the growing influence of billionaires in politics, enacting stricter ethics rules becomes not just necessary but crucial for preserving public trust. Critics of current practices argue that allowing corporate leaders unfettered access to policymaking places the interests of a few far above those of many. This sentiment reverberates strongest among advocates striving for a government that prioritizes the public good over corporate agendas.

The Intricacies of Implementation

However, the SEER Act faces potential pitfalls in its implementation. The proposal establishes that after serving 130 days, SGEs would be barred from receiving compensation tied to their non-government roles, but how realistic is enforcement? Provisions for conflict-of-interest waivers are also included, yet these need public oversight—an often cumbersome and bureaucratic process. Furthermore, will the Office of Government Ethics be equipped to manage the renewed demands? Skepticism surrounds whether this initiative will truly lead to accountability or simply act as a political theater for those eager to appear proactive without enacting real change.

A Double-Edged Sword

While the SEER Act aims to raise ethical standards, it’s essential to question whether this reform can accurately assess the unique challenges posed by SGEs. In the current political climate, the act risks being seen as a tool for vendetta against certain high-profile individuals rather than a genuine attempt to restore public confidence in government. Are we willing to accept that some SGEs might contribute invaluable expertise while simultaneously cultivating conflicts of interest? Reform must find a nuanced balance between ethical standards and the dynamic nature of American industry and advisory roles.

The SEER Act shines a light on the murky ethics surrounding SGEs. Still, one has to wonder whether we are witnessing a watershed moment for governance or merely scratching the surface of a deeper issue.

Leave a Reply