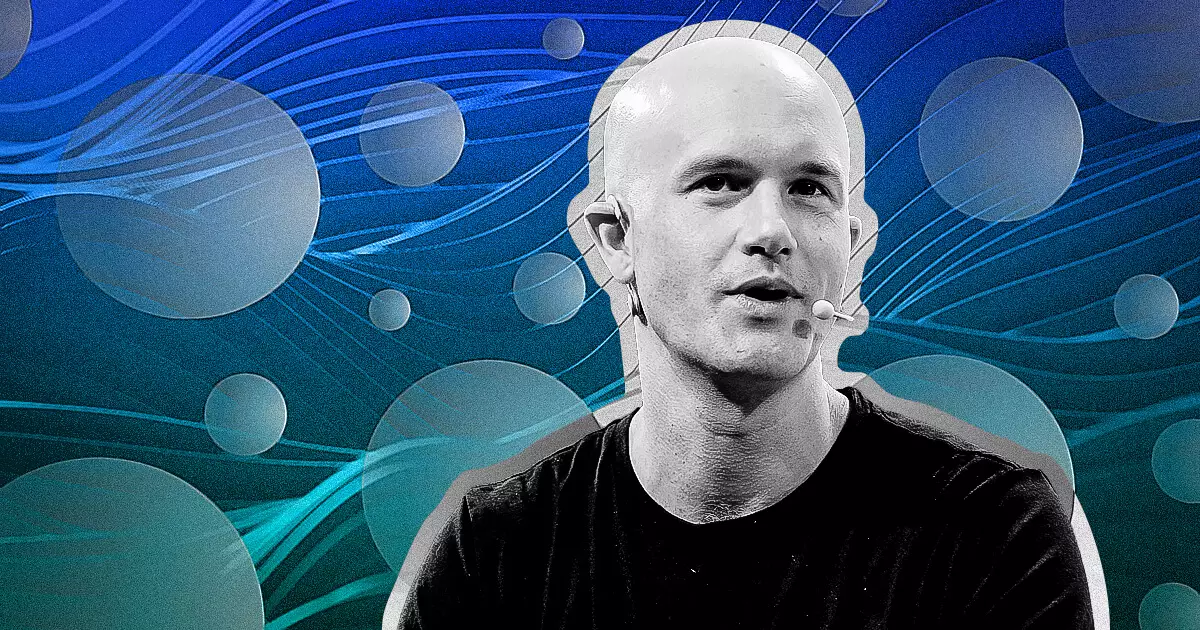

The cryptocurrency sector is experiencing an unprecedented surge, characterized by rapid innovation and an overwhelming influx of new digital assets. Recently, Brian Armstrong, the CEO of Coinbase, made a clarion call for an overhaul in how tokens are listed, underscoring the limitations of traditional asset evaluation mechanisms in the face of this explosive growth. This article will delve into the implications of his statements, explore the proposed solutions, and discuss the broader landscape of regulatory adaptation necessary for the evolving cryptocurrency environment.

Each week, estimates suggest that as many as 1 million new tokens enter the market. This astonishing proliferation poses a significant challenge to current listing systems that are largely dependent on manual, centralized processes for assessment and approval. Armstrong pointed out that the methods traditionally employed are no longer feasible in a world where token generation tools and no-code blockchain platforms are democratizing the ability to create and distribute digital currencies. The gap between innovation pace and systemic capacity to evaluate new entries is growing, raising essential questions about safety, regulation, and user empowerment.

Armstrong advocates for a shift toward a block-list approach, which entails a paradigm where new tokens are presumed to be legitimate until proven otherwise—a stark contrast to the prevailing “approval first, then launch” methodology. In this proposed model, the responsibility would be shared with the community, utilizing user feedback and automated analytics to highlight risks associated with new tokens. By doing so, Armstrong argues that this would not only maintain user safety but also significantly enhance scalability within the ecosystem.

This change would represent a significant cultural shift in how digital assets are managed and evaluated. The suggestion is not merely a procedural update; it reflects a recognition that innovation in cryptocurrency is not just inevitable, but essential. By decentralizing the validation and approval process, users are afforded more control, which aligns with the foundational principles of blockchain technology itself.

However, calling for such significant changes in token listing processes inevitably raises the question of regulatory frameworks. Armstrong emphasized that existing regulations are outdated when measured against the rapid pace of crypto innovation. To navigate this challenge effectively, he underscores the importance of public and private sector collaboration. Regulatory bodies must not only re-evaluate their strategies but also encourage an environment that fosters innovation while ensuring investor safety.

The cryptocurrency market’s dynamic nature necessitates an agile regulatory framework that can adapt to new developments swiftly. By integrating regulatory thinking with technological advancements, both industries can work together to forge pathways that benefit users without stifling the creativity and utility offered by blockchain technologies. Armstrong’s call for innovative regulatory practices reflects a broader sentiment within the crypto community that urges for a recalibration of traditional oversight models.

Moreover, Armstrong’s remarks were not limited to the immediate concerns of token listings. He also noted that Coinbase is committed to tightening its integration with decentralized exchanges (DEXs). The company aims to streamline users’ access to both centralized and decentralized trading modalities, making it easier for users to navigate the entire blockchain ecosystem with a seamless experience.

As one of the premier crypto exchanges globally, Coinbase possesses a unique advantage and responsibility to set industry benchmarks. By innovating its platform to support both centralized and decentralized trading, Coinbase is positioned to offer a user-centric experience that could serve as a model for other platforms. Armstrong’s vision aligns the company’s operational goals with broader principles of transparency, decentralization, and user empowerment.

Brian Armstrong’s insights spotlight the critical intersection of rapid innovation and regulatory evolution within the cryptocurrency field. His proposal for a revised token listing process, coupled with calls for regulatory innovation, presents a framework for the future. As this industry continues to evolve, it is vital for both creators and regulators to engage in dialogue about establishing systems that support innovation while safeguarding user interests. The path forward will require cooperation, adaptability, and a willingness to embrace new methodologies in evaluating and listing digital assets. The future of cryptocurrency hangs in the balance, and the actions taken today will undoubtedly define the landscape of tomorrow.

Leave a Reply