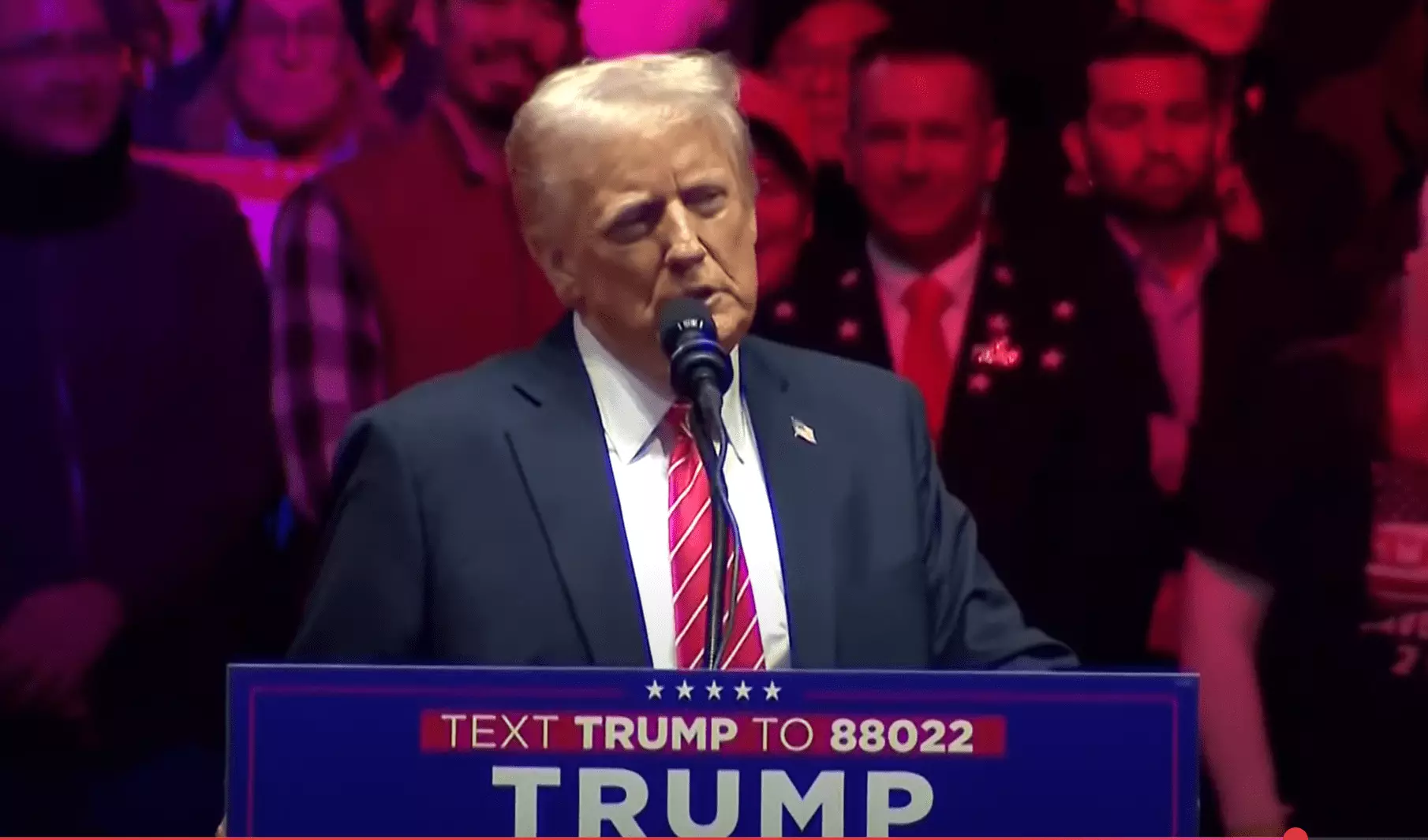

In a remarkable twist in the cryptocurrency landscape, Bitcoin recently catapulted to a staggering all-time high of $109,558. This surge occurred during the early trading hours in Asia, coinciding intriguingly with the inauguration of President Donald Trump. Market analysts and crypto enthusiasts alike have been abuzz with speculation regarding a theoretical initiative by Trump to create a Strategic Bitcoin Reserve (SBR). The possibility of such a reserve being established through an executive order has captured widespread attention, particularly since Trump might issue up to 100 executive orders as he takes office. This potential move signals significant interest in incorporating Bitcoin into the financial strategies of the U.S. government.

The prediction marketplace, Polymarket, revealed a noteworthy spike in the probability that Trump would enact an SBR within the first 100 days of his presidency, climbing to 59%. This sudden increase in odds appeared to coincide with the peak in Bitcoin’s value, indicating that investors were likely reacting to the potential of government-backed Bitcoin initiatives. The idea of a U.S. Bitcoin reserve has been in circulation for months; however, Trump’s inauguration has intensified these discussions. Speculators believe that a government-held Bitcoin reserve could reshape the landscape of cryptocurrency, providing a new layer of legitimacy and stability to the often-volatile market.

For many, the link between Trump’s administration and Bitcoin is not unfounded. Over the past weekend, key Bitcoin advocates convened with Trump’s team, deepening the speculation surrounding governmental support for cryptocurrency. Prominent figures such as Senators John Barrasso and Cynthia Lummis have openly discussed their pro-Bitcoin positions, suggesting a favorable environment for digital asset legislation. Lummis, in particular, has been a vocal supporter of Bitcoin, pushing her legislative proposal known as the “Bitcoin Bill.” Her plan aims to procure a staggering one million bitcoins for government holdings, reflecting an aggressive strategy to bolster the stability of Bitcoin in the American economy.

Influence of Bitcoin Advocates

The involvement of influential crypto figures adds weight to the narrative of a changing attitude towards Bitcoin within the government. Michael Saylor, the Chairman of MicroStrategy, was seen engaging with notable members of Trump’s cabinet, showcasing unity among Bitcoin advocates. His interactions, particularly with Eric Trump and other industry leaders, have been underscored by statements of optimism regarding the future of Bitcoin under the new administration. Comments from Saylor about the potential to innovate financial systems resonate with many who view cryptocurrency as a pivotal player in the evolution of currency.

As the inauguration unfolded, various analysts and market observers prepared for what they termed a watershed moment for Bitcoin. The meetings and discussions held at high-profile receptions suggested that the White House was increasingly receptive to engaging with cryptocurrency advocates. Notable names in the cryptocurrency sector, like Fred Thiel of MARA Holdings, were reportedly present at significant governmental events, signaling an unprecedented integration of cryptocurrency within political conversations.

In light of this trajectory, analysts like Charles Edwards have remarked on the volatility commonly associated with Bitcoin but also emphasized the potential for a significant bullish trend. Edwards suggested that aggressive market movements in either direction might indicate an emerging trend, urging investors to remain optimistic about forthcoming developments surrounding Bitcoin’s acceptance and integration into governmental structures.

The intertwining of Bitcoin with governmental initiatives, particularly under a Trump-led administration, marks a significant moment in the nascent history of cryptocurrency. The prospects of establishing a Strategic Bitcoin Reserve could not only validate the market but also potentially open doors for broader acceptance and integration of digital currencies in everyday transactions. As the landscape continues to evolve, it remains crucial for investors and enthusiasts alike to stay attuned to the developments coming from Washington. Such investments and governmental strategies could redefine not just the value of Bitcoin but also its role in the global economy, heralding an era where cryptocurrency emerges as a mainstream financial instrument. The future may very well herald a new chapter for Bitcoin as America navigates its position as a potential superpower in the cryptocurrency sphere.

Leave a Reply