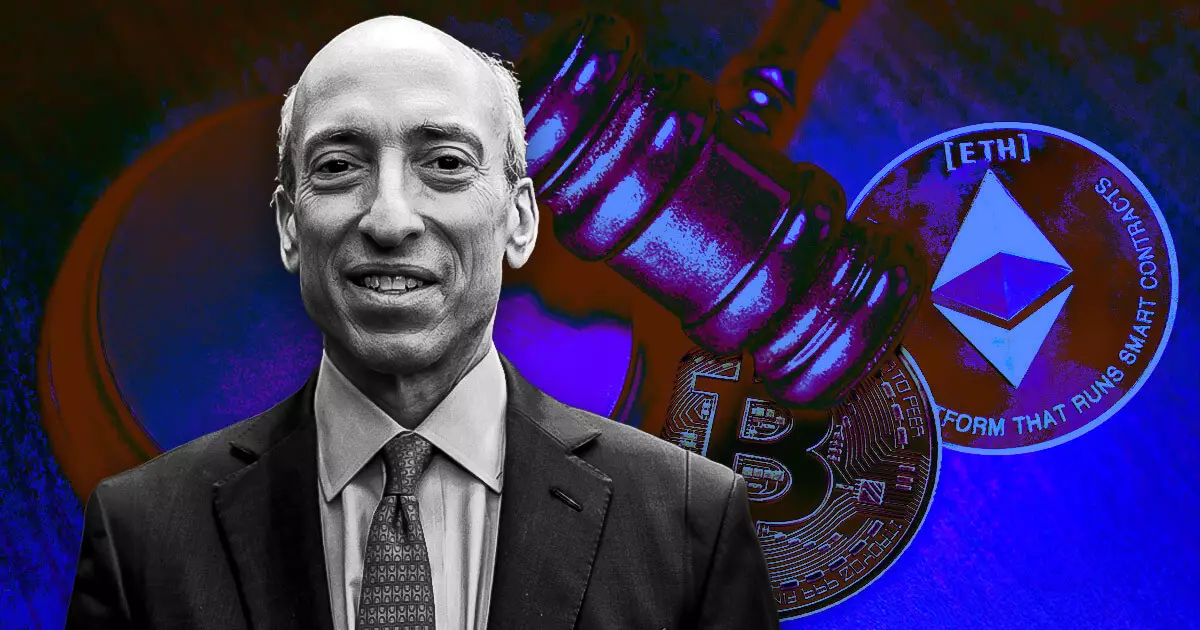

The recent announcement from the U.S. Securities and Exchange Commission (SEC) regarding the rejection of two spot Solana (SOL) exchange-traded fund (ETF) applications has stirred considerable discussion in the cryptocurrency community. Industry analysts suggest that this decision might reflect outgoing SEC Chair Gary Gensler’s stance on crypto regulation as he approaches the end of his term. According to Bloomberg’s ETF senior analyst Eric Balchunas, the rejections serve as Gensler’s “parting gift” to the crypto industry, signaling a stringent regulatory environment as he prepares to vacate his position.

Sources from Fox News indicate that representatives from the Solana ETF issuers were informed that under Gensler’s leadership, no new crypto-related ETFs would be approved. This is a significant moment in the regulatory landscape, especially as Gensler’s resignation date looms closer, set for January 20, 2025. With incoming SEC Chair Paul Atkins, who has been confirmed by President-elect Donald Trump, analysts anticipate a potential shift in the agency’s approach toward crypto ETFs.

The ongoing regulations surrounding cryptocurrencies are complex and fraught with challenges. Gensler’s SEC has taken a firm stand on the notion that many cryptocurrencies, including SOL, should be classified as securities. This classification is central to understanding why the current applications for Solana ETFs are likely to be postponed indefinitely.

James Seyffart, a Bloomberg ETF analyst, asserted that permitting SOL-related ETFs while simultaneously alleging that the cryptocurrency is a security in legal disputes would be “disingenuous.” He predicts that until the SEC clarifies its stance on these lawsuits, applications for Solana ETFs are essentially “dead in the water.” This uncertainty prolongs the timeline for approval, which Seyffart earlier anticipated would culminate by August 2025, noting that even this deadline might be optimistic.

The rejections raise broader questions about the future of cryptocurrency investments and market accessibility. The crypto sector has faced regulatory scrutiny and fluctuating policies, which has impacted investor confidence. Gabor Gurbacs, a voice in the crypto community and former director of digital asset strategy at VanEck, expressed a sense of relief over Gensler’s impending departure, questioning the viability of current policies.

Moreover, the situation highlights that the incoming SEC administration will inherit a multitude of pending decisions related to crypto regulations, including lawsuits like the Binance case. Recently, Stuart Alderoty, Ripple’s chief legal officer, pointed out the SEC’s aggressive legal stance by filing an 81-page document urging a court not to dismiss a lawsuit against Binance, accusing it of offering tokens as investment contracts. This indicates that the regulatory landscape is fraught with tension and that new leadership will need to tackle substantive legal challenges while simultaneously fostering an environment conducive to innovation.

The rejection of the Solana ETF applications by the SEC exemplifies the complexities and challenges of cryptocurrency regulation. As the industry faces a pivotal transition with new leadership anticipated, it remains to be seen how future policies will shape the acceptance and growth of cryptocurrency investment vehicles. Stakeholders might find a glimmer of hope for potential changes in the crypto regulatory environment, but such changes will require a thoughtful and considerate approach to balance innovation with necessary oversight. The coming months could be crucial in determining the future trajectory of cryptocurrency ETFs and the industry as a whole.

Leave a Reply