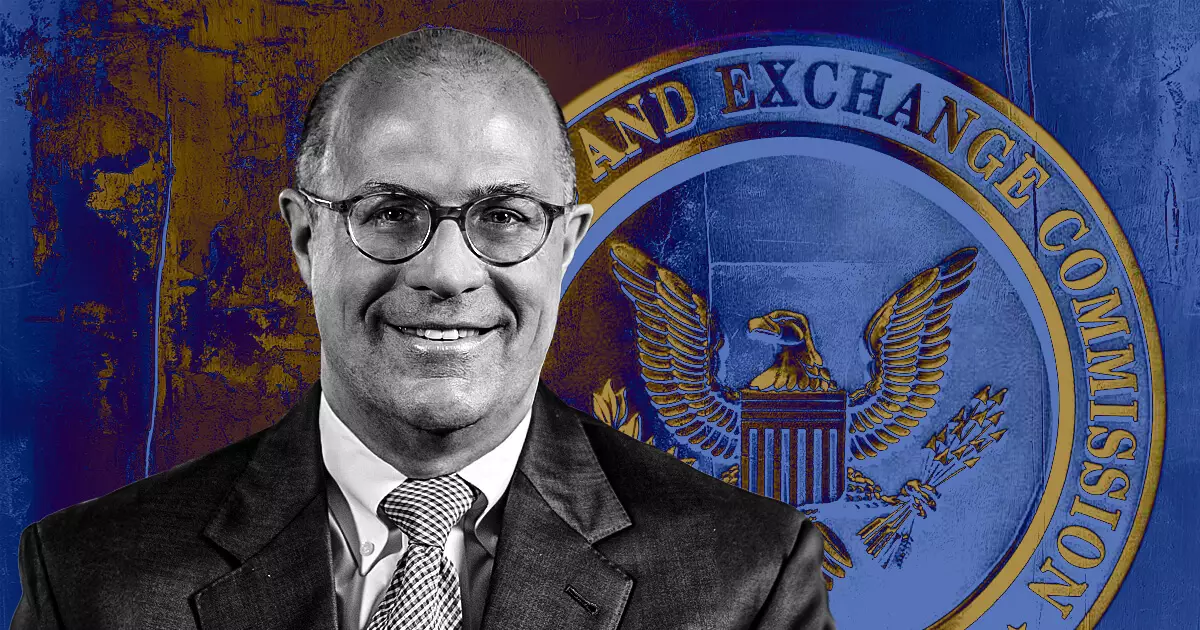

In the ever-evolving landscape of cryptocurrency regulation, former Commodity Futures Trading Commission (CFTC) Chair Christopher Giancarlo has stepped into the spotlight to refute rumors about potential nominations for the Chair position of the US Securities and Exchange Commission (SEC). The speculation regarding Giancarlo’s return to a high-ranking regulatory role comes at a time when the SEC is facing significant scrutiny and backlash for its enforcement-driven approach towards the cryptocurrency sector. By publicly denying his interest in this position, Giancarlo implies a disinterest in returning to a regulatory environment that he has described as chaotic. His previous experiences suggest a reluctance to step back into the fray, particularly regarding the SEC’s current legacy under Gary Gensler, which he perceives to be flawed.

Cleaning Up Gensler’s Mess

Giancarlo’s reference to having “cleaned up earlier Gary Gensler mess” hints at unresolved concerns within the SEC regarding regulatory frameworks for digital currencies. Although Giancarlo refrained from elaborating on what he labeled as a “mess,” it is likely an allusion to Gensler’s controversial approach—characterized by rigorous enforcement rather than proactive regulatory guidance. This method has been criticized by various industry stakeholders and some SEC commissioners who contend that it results in a lack of clarity for market participants. Giancarlo, who has earned the moniker “Crypto Dad” for his supportive stances on cryptocurrencies, appears to advocate for a more balanced regulatory landscape that encourages innovation while protecting investors.

The Ripple Effect of Gensler’s Stance on Regulation

SEC Chair Gary Gensler’s robust defense of the Commission’s stance underscores the complex interplay between regulation and innovation in the burgeoning crypto market. Gensler argues that most digital assets should be classified as securities, thereby subjecting them to stringent SEC oversight. This assertion defines a new landscape where compliance becomes not just a hurdle for existing companies but a critical factor in determining the fate of emerging digital assets. By positioning the SEC as a vigilant defender of investors, Gensler defends his aggressive regulatory measures as paramount to preventing fraud and ensuring market integrity.

Despite these intentions, many industry participants perceive the SEC’s current framework as a barrier to entry that inadvertently stifles innovation. Gensler’s administration has seen litigation against top exchanges such as Binance and Coinbase, which has sparked criticism and calls for more transparent regulatory guidelines. Critics argue that these actions create an unpredictable environment that hinders the growth of the cryptocurrency sector, echoing frustrations shared during Giancarlo’s tenure at the CFTC.

As the drama between regulatory authorities and the cryptocurrency industry continues to unfold, the dialogue surrounding the future of crypto regulation remains as pertinent as ever. Giancarlo’s reluctance to engage with an increasingly complicated SEC landscape raises significant questions about the direction the regulatory framework may take. While Gensler contends that rigorous enforcement is necessary to protect investors, many in the crypto community are left yearning for clearer guidelines and collaborative dialogue. Without a pivot towards a more supportive regulatory approach, the burgeoning promise of cryptocurrency and blockchain technology may be at risk of stagnation in the long term. The need for constructive engagement between regulators and the industry cannot be overstated, as it is crucial for fostering an environment where innovation can thrive without compromising investor safety.

Leave a Reply