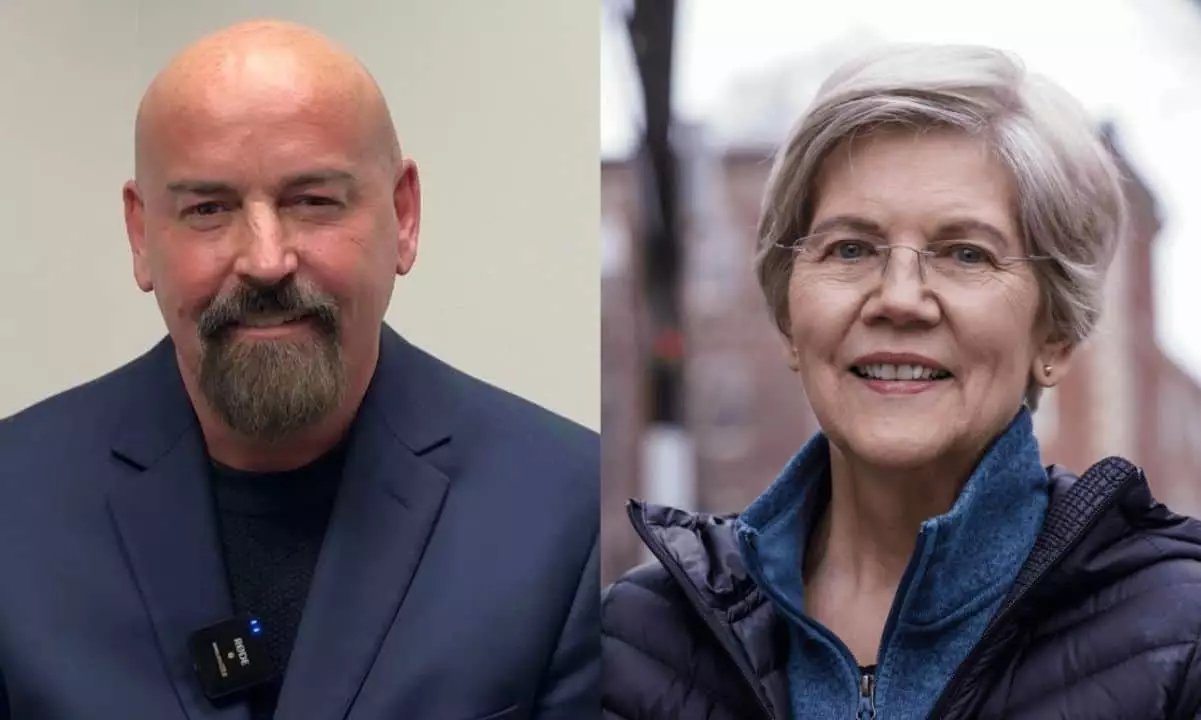

In a recent debate that captured the attention of both political pundits and cryptocurrencies enthusiasts, incumbent Massachusetts Senator Elizabeth Warren faced off against her opponent, John Deaton, a lawyer and advocate for digital assets. The discussion unfurled an intricate web of arguments centered around the role of cryptocurrency in modern finance and the implications of government regulation. This debate not only illuminated the candidates’ differing perspectives but also reflected broader national sentiments toward digital assets at a time when their future appears contentious.

Warren, known for her critical stance on cryptocurrencies, launched direct accusations against Deaton, asserting that his potential victory could see him serving as a “mouthpiece” for the crypto industry rather than representing the interests of his constituents. This assertion set the stage for a deep dive into the core principles governing their respective positions on finance, regulation, and consumer protection. The debate co-host Jon Keller adeptly introduced the topic, emphasizing the stark contrast between Warren’s skepticism regarding cryptocurrency and Deaton’s advocacy for its potential benefits.

Deaton took advantage of the debate to present a narrative that underscores cryptocurrency’s role as an alternative financial solution for individuals lacking access to traditional banking infrastructures. He shared a poignant personal story about his mother, who had suffered due to restrictive banking practices and exorbitant fees. His argument, rooted in the idea that cryptocurrencies can provide more equitable financial opportunities, connects emotionally with voters who may feel abandoned by conventional financial systems.

In stark contrast, Senator Warren reiterated her mission to build an “anti-crypto army,” expressing concern over the potentially harmful aspects of unregulated digital assets. She insisted that without strict oversight, cryptocurrencies could exacerbate issues like money laundering and economic instability. This pledge positioned her as a guardian of consumer rights, asserting that crypto should adhere to the same regulations as banks to protect citizens.

While economic efficacy was a prominent theme, the debate also shifted toward campaign finance. Senator Warren pointedly criticized Deaton’s financial backing from the cryptocurrency sector, suggesting that his reliance on funds from blockchain interests could compromise his integrity should he be elected. Warren’s statement, aimed at casting doubt on Deaton’s authenticity, highlighted the pervasive relationship between politics and money—the notion that financial contributions can influence a candidate’s policy decisions.

However, Deaton did not shy away from the accusations. He countered Warren’s claims by calling out her associations with corporate Political Action Committees (PACs), effectively flipping the narrative back on her. By pointing this out, he sought to establish a precedent that while both candidates have financial ties, the motivations behind their respective affiliations hold significantly different implications for voters.

As the discussion evolved, Deaton invoked the Ripple v. SEC case, positioning himself as a defender of consumers against regulatory overreach. He painted a picture where oversight is necessary, but not at the expense of innovation and accessibility for the average American. Deaton’s assertion that Warren’s policies appeared beneficial to the financial elite rather than the ordinary person struck a chord, igniting debate about who truly benefits from proposed regulations.

Simultaneously, Warren maintained that her intentions stemmed from a place of concern for consumer safety. She emphasized that while she is not inherently opposed to cryptocurrency, it must adhere to a framework that guarantees protections akin to those wielded by banks and credit unions. This call for parity in regulation illustrates a significant concern among critics that without oversight, digital currencies could lead to detrimental outcomes for everyday Americans.

The debate concluded with no clear consensus, illustrating that the world of cryptocurrencies is as challenging to navigate as the waters of contemporary politics. Each candidate presented compelling visions of what they hope to achieve. As financial systems evolve and adapt to technological advancements, voices like those of Warren and Deaton will likely shape the pathways that cryptocurrencies will follow in Massachusetts and beyond. The future of digital assets hangs in a delicate balance, suspended between innovation and regulation, consumer protection, and financial freedom.

Leave a Reply