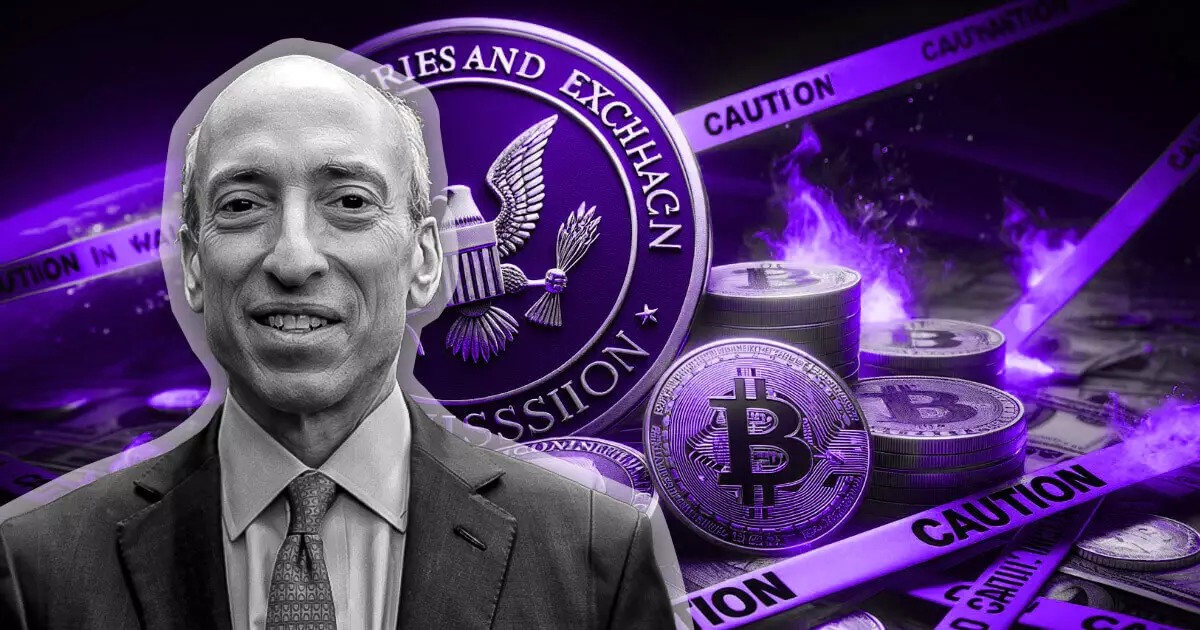

In a recent discussion on CNBC, Gary Gensler, the Chair of the US Securities and Exchange Commission (SEC), provided essential clarification regarding the regulatory classification of Bitcoin, affirming its status as a commodity rather than a security. This statement comes at a pivotal moment as the cryptocurrency market navigates increasing regulatory oversight. Gensler emphasized that both he and his predecessor have consistently held that Bitcoin does not fall under the definition of a security, which could have significant implications for its treatment under US law. By clearly designating Bitcoin as a commodity, Gensler seeks to alleviate some uncertainty surrounding its trading and ensure its continued integration into financial markets.

While emphasizing Bitcoin’s clear classification, Gensler did not shy away from expressing his concerns about the broader cryptocurrency sector. He criticized many market participants for their tendency to flout existing regulations, which he believes has resulted in market instability and uncertainty. His assertion that “many have chosen to ignore” established rules resonates with critics who argue that a lack of compliance undermines the integrity of the market. This raises fundamental questions about the responsibility of companies operating within the crypto space and the potential consequences of their non-compliance, which may further complicate the situation for investors.

Gensler’s comments ultimately do not extend the same clarity to Ethereum, which continues to exist in a murky regulatory environment. The SEC’s indecision on whether Ethereum is considered a security creates a precarious situation for projects and companies that operate within its ecosystem. Despite the approval of Ethereum-based ETFs, the agency’s scrutiny has raised alarms among developers and investors, as ongoing investigations into well-known firms signify a lack of regulatory clarity. This ambiguity highlights a fundamental inconsistency that perplexes even seasoned market players, leading to concerns that innovation may be stifled due to fear of regulatory repercussions.

Gensler’s regulatory approach has faced pushback from members of Congress and other SEC commissioners, suggesting that his strategy may be fostering confusion rather than clarity in the crypto legislative arena. The introduction of ambiguous terms such as “crypto asset security” has further complicated the conversations surrounding regulation. Lawmakers have voiced their frustrations, arguing that the SEC’s current strategies could inhibit the innovation that is critical to the growth and diversification of the digital asset market.

Despite the critiques, Gensler remains steadfast in his belief that the future of the cryptocurrency industry hinges on establishing robust regulatory frameworks. He posits that the success of the market is directly linked to building investor trust. Drawing parallels to traditional industries, Gensler likens regulatory guidelines to essential traffic rules that facilitate orderly progression. He argues that without such frameworks, it will be challenging for the cryptocurrency sector to endure and thrive in the long term.

As Bitcoin enjoys a clear regulatory path, the uncertain future of Ethereum embodies the challenges that persist within the cryptocurrency landscape. Moving forward, the dialogue around regulation and compliance will be pivotal in shaping the trajectory of the market and ensuring that it evolves responsibly and sustainably.

Leave a Reply