Judge Katherine Polk Failla recently criticized Coinbase’s attempts to subpoena SEC chair Gary Gensler in the SEC’s ongoing case against the firm. Failla expressed her concern over Coinbase’s request for Gensler’s statements before he became SEC chair in 2021, deeming the arguments put forth by Coinbase’s lawyer as “speculative” and lacking persuasiveness. Despite acknowledging Coinbase’s concerns, Failla highlighted the difficulties the company might face in obtaining Gensler’s pre-chair statements.

SEC lawyer Jorge Tenreiro further solidified the opposition against Coinbase’s request, labeling it as “incredibly intrusive” towards a public official. Tenreiro emphasized that the focus of the proceedings should revolve around the SEC’s actions rather than Gensler’s past statements. He also argued that Gensler does not serve as a fact witness or an expert witness on the law, urging the court to quash Coinbase’s subpoena request.

In an attempt to support their position, Coinbase’s lawyers referenced a case involving Ripple where the court ordered the discovery of multiple custodians, including then-SEC chair Jay Clayton. However, Tenreiro responded by highlighting a filing in which the SEC aimed to prevent Ripple from accessing certain information, including by searching SEC staff’s personal devices. This comparison raises questions about the relevance and proportionality of Coinbase’s extensive requests for information concerning Gensler.

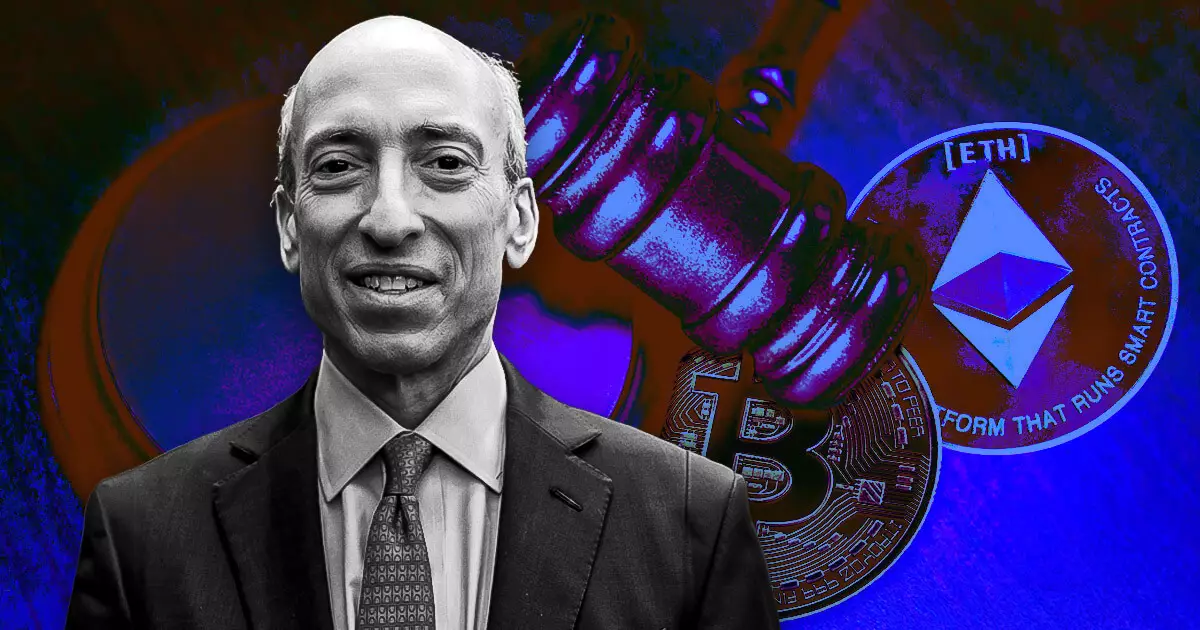

The legal battle between Coinbase and the SEC has escalated with Coinbase’s persistent demands for documents and communications related to Gensler’s public statements on digital assets, platforms, and staking services. The company asserts that Gensler’s past statements are crucial for its defense, particularly in establishing fair notice and determining the reasonableness of the SEC’s actions against it. The SEC initiated the lawsuit against Coinbase in June 2023, accusing the firm of operating as an unregistered exchange, broker, and clearing agency, as well as engaging in unregistered offerings and sales of securities through staking-as-a-service.

By delving into the intricacies of the legal dispute between Coinbase and the SEC, it becomes evident that the case involves complex issues surrounding regulatory compliance, information disclosure, and the boundaries of legal discovery. The diverging perspectives of Judge Failla, Coinbase, and the SEC underscore the challenges inherent in navigating legal proceedings in the cryptocurrency industry, where regulatory ambiguity and enforcement actions intersect. As the case unfolds, the outcome will not only impact Coinbase’s legal standing but also have broader implications for how regulatory agencies interact with crypto companies in the evolving financial landscape.

Overall, the contentious debate over the subpoena request for SEC chair Gary Gensler’s statements serves as a microcosm of the larger tensions between industry players and regulatory authorities in the crypto space. The need for clarity, transparency, and procedural fairness in regulatory enforcement underscores the importance of a balanced and judicious approach to resolving legal disputes in a rapidly evolving industry. As Coinbase and the SEC continue to spar in court, the outcome of this case has the potential to set a precedent for future interactions between cryptocurrency firms and regulatory bodies, shaping the regulatory landscape for digital assets in the years to come.

Leave a Reply