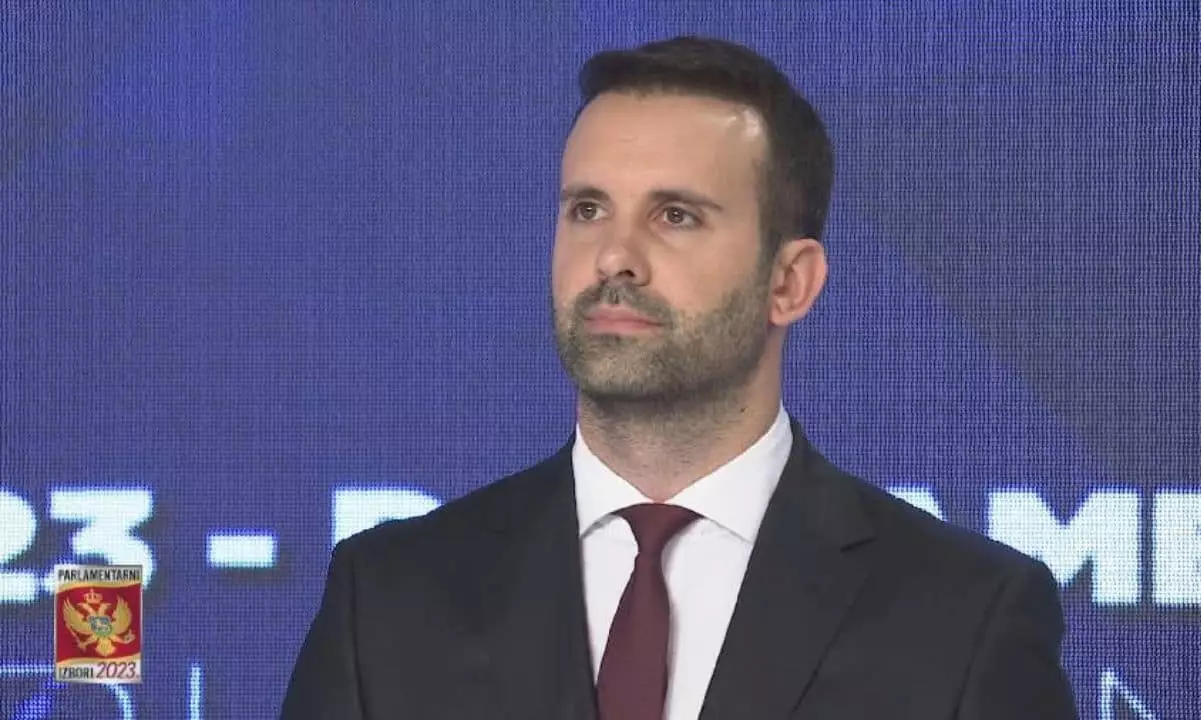

Montenegrin Prime Minister Milojko Spajic’s involvement as one of the early investors in Terraform Labs has recently come to light. Court documents released by the U.S. Securities and Exchange Commission (SEC) reveal that Spajic made an initial investment of $75,000 in April 2018, acquiring 750,000 Luna tokens. At their peak, these tokens were valued at a staggering $90 million. However, the cryptocurrency project ultimately failed in 2022, resulting in losses exceeding $40 billion for investors worldwide.

Despite the high risks associated with early-stage investments, Spajic was able to acquire Luna tokens at a significantly low price of $0.10 each. This price was the lowest offered during subsequent funding rounds, making his investment all the more enticing at the time.

It has been revealed that Spajic did not report owning Luna tokens to the Agency for the Prevention of Corruption. In his 2020 and 2021 reports, he declared owning Bitcoin worth €150,000 and listed various other cryptocurrencies without specifying their values in subsequent reports. There has been speculation about whether Spajic asked Do Kwon to return his investment or compensate for lost profits, but the details remain murky.

Terraform Labs and Kwon have since been held accountable for defrauding investors. The SEC secured a settlement requiring the company to pay $4.37 billion in fines and interest, with Kwon contributing $200 million to an investor compensation fund. Kwon, who is currently detained in Montenegro, faces possible extradition to either the United States or South Korea for trial.

Montenegrin Prime Minister Milojko Spajic’s involvement in Terraform Labs’ failed cryptocurrency project serves as a cautionary tale about the risks of early-stage investments and the importance of transparency in financial dealings. The repercussions of this investment have been far-reaching, resulting in massive losses for investors and legal actions against those responsible for the fraud.

Leave a Reply