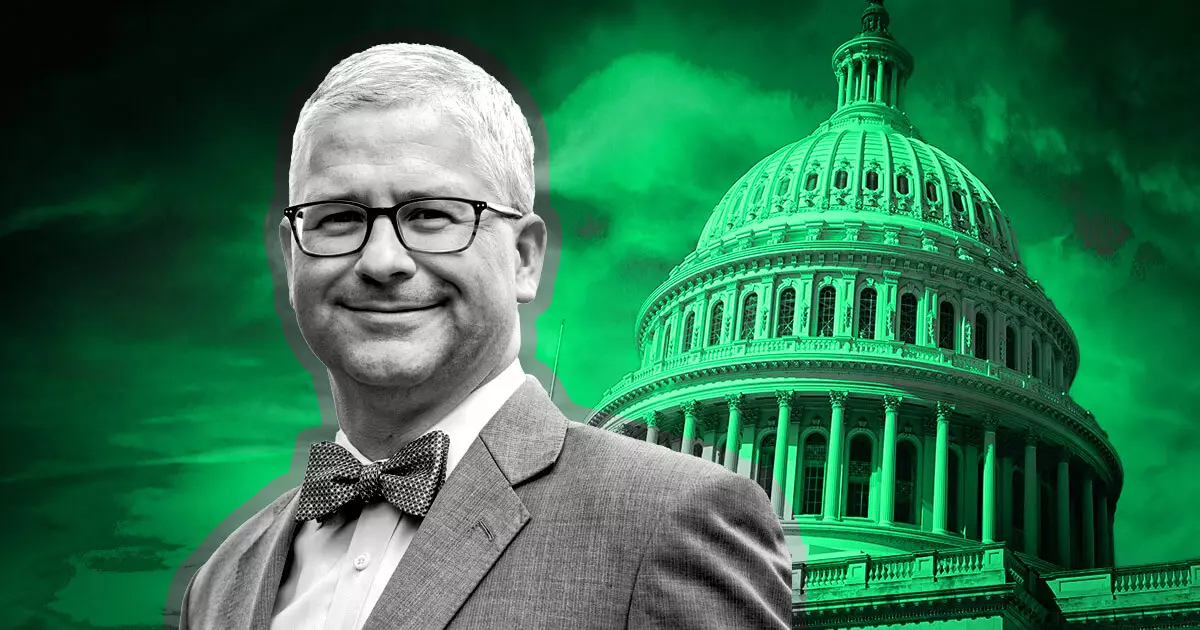

House Financial Services Committee Chairman Patrick McHenry has announced that new legislation, known as the Financial Innovation and Technology for the 21st Century (FIT21) Act, is on track for a potential House floor vote by the end of May. This legislation is designed to provide much-needed clarity regarding regulatory oversight for the crypto industry, addressing long-standing issues related to market oversight and consumer protection. The consideration process for the FIT21 Act is aimed at giving the legislation the necessary time and attention it requires to move forward successfully.

According to McHenry, the U.S. digital asset ecosystem has suffered from regulatory uncertainty for too long, leading to stifled innovation and a lack of consumer protection. The FIT21 Act could be a game-changer for the industry, providing a clear regulatory framework for digital assets that will benefit both businesses and consumers alike. The proposed legislation aims to establish clear lines of jurisdiction between the Commodity Futures Trading Commission (CFTC) and the Securities and Exchange Commission (SEC), addressing a key issue that has been a point of contention in recent years.

One of the key provisions of the FIT21 Act is the assignment of jurisdiction over crypto commodities to the CFTC and jurisdiction over crypto offered as investment contracts to the SEC. This distinction aims to provide clarity for crypto developers seeking to raise funds and ensure that they understand which regulatory body oversees their activities. In addition, the legislation creates a process for permitting the secondary market trading of crypto commodities that were initially offered as investment contracts, further enhancing liquidity and market access for digital assets.

Furthermore, the FIT21 Act sets out rules for companies operating in the crypto space, including requirements around customer disclosure, asset safeguarding, and operational standards. By establishing clear guidelines for registration with the SEC and CFTC, the legislation aims to create a more transparent and compliant industry that prioritizes consumer protection and market integrity. The introduction of the FIT21 Act in 2023 by a group of bipartisan lawmakers highlights the widespread support for regulatory clarity in the crypto industry.

The potential impact of the FIT21 Act on the crypto industry could be significant, providing much-needed regulatory clarity and oversight that will facilitate innovation and consumer protection. By establishing clear lines of jurisdiction between regulatory bodies and setting out rules for market participants, the legislation has the potential to shape the future of the digital asset ecosystem in the United States. As the consideration process moves forward, all eyes will be on the House floor vote at the end of May to determine the next steps for the FIT21 Act and its potential implications for the industry.

Leave a Reply