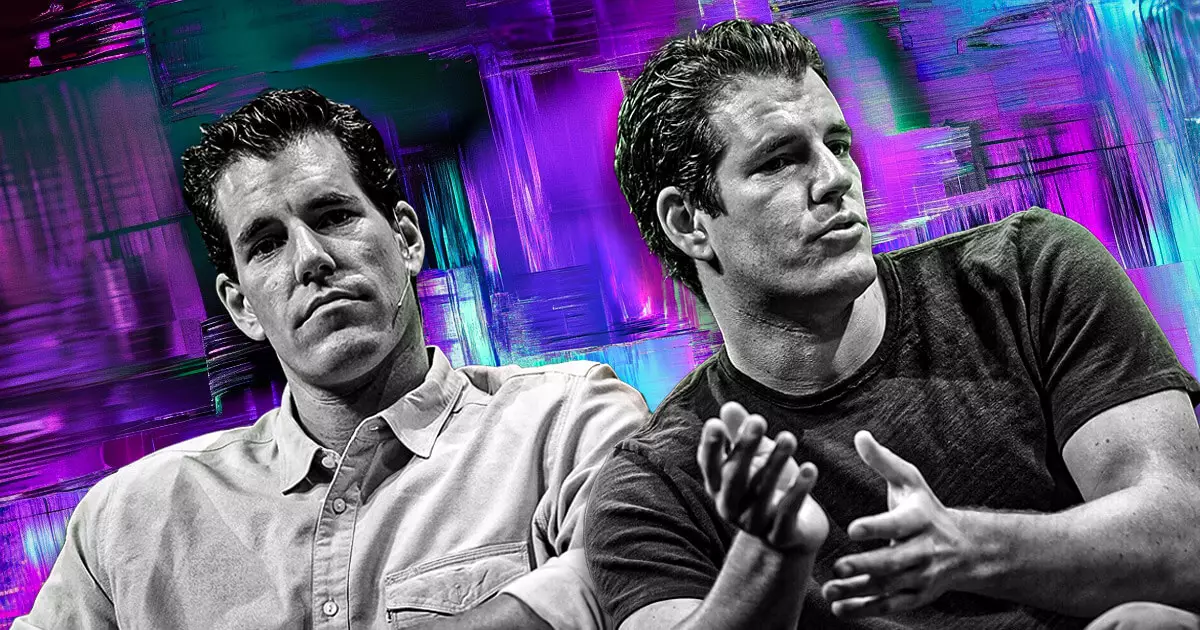

Gemini’s recent decision to file a draft registration statement with the U.S. Securities and Exchange Commission (SEC) for its initial public offering (IPO) signals a pivotal moment in the evolving landscape of cryptocurrency exchanges. The Winklevoss twins, Cameron and Tyler, are not simply following a trend; they are boldly defining one. With their move toward public capital markets, Gemini stands poised to transform not just their own fortunes, but the broader acceptance and legitimacy of digital assets as investment vehicles.

The Countdown Begins: Regulatory Hurdles and Market Readiness

While excitement simmers over the potential IPO, the operational realities more than ever underscore the importance of regulatory compliance and market conditions. Gemini needs to navigate the SEC’s rigorous scrutiny and finalize terms before it can present its offering to potential investors. This painstaking process isn’t merely bureaucratic; it represents the intense importance of adherence to regulatory frameworks in a space often criticized for its lack of oversight. The manner in which Gemini handles these hurdles will potentially set the standard for other exchanges looking to enter the public domain.

Circle’s IPO: A Trailblazer or a Fluke?

The performance of Circle’s recent IPO offers lessons embroidered with both encouragement and caution. With initial stock prices soaring before stabilizing, Circle’s stock movements illustrate the volatility synonymous with cryptocurrency markets. While it initially priced at $31 and surged to $103.75 within a mere half-hour, subsequent dips remind investors that the euphoria surrounding digital asset companies is tempered by market realities. The earnings-centric nature of such companies, however, has been highlighted in industry discussions, with analysts like Jason Yanowitz noting that investment banks are viewing this moment as “go time” for digital platforms. If Gemini can follow suit, it could validate the profitability and stability of crypto companies in public equity.

The Pressure to Perform: Expectations Crowding a New Era

Market expectations have dramatically shifted, especially following Circle’s IPO results. Investors are no longer merely speculators; they are scrutinizing balance sheets and revenue streams with newfound vigor. This shift places immense pressure on Gemini to not only establish but also disclose operational stability and profitability. Under the current climate, the implications of public representation extend beyond just financial gain—companies must work to earn trust and fulfill promises to a market that is simultaneously captivated and skeptical.

A New Dawn for Cryptocurrency Acceptance

The pending IPO from Gemini arrives at a strategically advantageous moment, given the current shift in the political atmosphere towards digital asset acceptance. Should the Biden administration exhibit a welcoming attitude towards regulation rather than hostility, the momentum could encourage a wave of exchanges to follow suit. This creates a unique opportunity for digital asset firms to redefine their roles within the wider financial ecosystem. Observers are keenly aware that a successful IPO from Gemini could catalyze an overarching transformation within the marketplace, inviting broader participation from established institutional players and reshaping public perception of cryptocurrency as a legitimate investment avenue. In this context, the stakes are exceptionally high—both for Gemini and the future of digital finance itself.

Leave a Reply